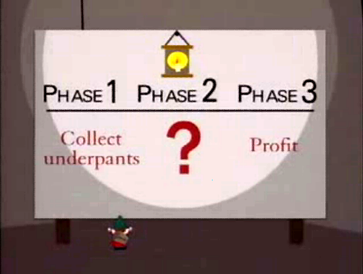

OK, I'm on record as not a South Park fan. But Rudy Giuliani's health care “plan” does remind me of an old episode, in which the thieving “underwear gnomes” reveal their business plan:

Here's Giuliani's advertised plan, as described by the AP:

In the spot, which his campaign said yesterday would air in New Hampshire, Giuliani proposes a deduction of $15,000 for a family or $7,500 for an individual, saying that would work much better than more government involvement.

“If we do that, and we end up with a market of 50, 60 million Americans buying their own health insurance, without a mandate, the cost of health insurance will come down and the quality will come up,” the former New York mayor says in the ad. “Government has never been able to reduce costs. Government never increases quality. We have the best healthcare system in the world. We just have to make it better.”

OK, let's summarize: Tax deductions + ? = 60 million people buying their own health insurance. Thanks, Underpants Gnomes! Curious that he's claiming that government can't do anything for health care … except for more tax cuts, the Republican's hammer for every nail, screw, or pane of glass.

As far as Giuliani's personal testimony, one of Ezra's commenters points out that Giuliani's prostate cancer treatment was invented by … a Danish physician, not “the best healthcare system in the world.” And of course, his health care was doubtless provided by his job … with the government. Best health care system in the world … if you're the mayor of New York freakin' City.

I have to wonder if those right-wing catchphrases — “socialized medicine”, “best healthcare system in the world”, “Hillarycare”, “government-run health care”, “health care from your doctor, not the government” — have passed their sell-by date. So little of that rhetoric seems to have changed in 40 years … or longer. Does it still scare people? Does it work? I can't imagine, but what do I know? I'm betting that those opposed to ambitious health care reform are going to have to find some new angles, some new catchphrases.

Massachusetts is going to “penalize” me on my taxes for not buying Health Insurance while Giuliani will “reward” me with a deduction. Neither is going to make me buy it when I’m unemployed and therefore have little income.

…which has a $10,000 lifetime limit, btw, and use it to fund the ‘free’ care pool at hospitals.

<

p>

Rudy is offering an incentive to purchase, which is less compelling – to me – than a penalty if you fail to purchase.

The MA plan does indeed penalize you on your taxes, as you say; but it also includes subsidies for those under $30k of income (for an individual); and a more rational purchasing environment. BTW, many of those market reforms (guaranteed issue, community rating, etc.) existed before the new law.

<

p>

Your point about the personal mandate is well-taken. I don’t think anyone has a good answer to that.

“Mass health” insurance…,cost? zero!… quality of insurance ? Unbelievable! better than the BCBS I had before when employed…. recently retired..now I pay( at a reduced rate based on SS income) for Commonwealth Care with again wonderful insurance for which I pay based on income level.

As far as I’m concerned this “means test” Mass program is the greatest ( and fairest)thing for health insurance ever.It should be made a National program.

The people that bitch about it are younger “why should I pay, I’m healthy” crowd that doesn’t need health insurance until they crash on their motorcycle, run up a big emergency treatment bill and then the chase is on for the payment which is paid for and added to the premium of those that do have insurance which is the way it has been forever here in the people’s Republik…. Those with insurance subsidze those who don’t (much like People’s Republik auto insurance) If the “I don’t want to pay for insurance crowd’ wants to bitch, then they should also refuse to pay taxes to fund schools( I don’t have kids, why should I pay?).. same logic.

I think the real problem here is that people are totally misinformed and ignorant of the provisions of the program and only see the “mandatory” requirement to have insurance.The reality is that it is a means tested requirement and by the way, if you’re too cheap to buy insurance, you’re not going to jail…you just forfeit that big fat tax deduction on the 75k you made and can no longer make the rest of us to pay for your “on demand” deadbeat emergency room bullshit

…a governemnt hand-out kind of guy? And praising the government program to boot…OK, where’s the camera…I’m being PUNK’d ain’t I?

I have no problem paying taxes to fund medical care for those who need it.

<

p>

I have a serious problem being required by law to enter a contract with a private company to cross-subsidize their CEO and someone else’s health care.

<

p>

It’s a matter of philosophy. Contribute to the common good by force? Sure. Contribute to a company exec’s salary by force? Not so good.

<

p>

Don’t paint us young ‘uns with an ugly brush for not wanting to be forced to pay more corporate handouts. After all, it’s our parent’s generation which is leaving us with the bill after giving huge corporate payouts to the war industry while ignoring long term investments at home. It’s our parent’s generation which will have 100% social security payouts and tax cuts, leaving burden on us. Why should you require your richer friends in your generation to pay more when you can just leave it for my generation to fix?

this first in the Nation Health care system actually works you would change your opinion.

First, no one is “forcing ” you to do anything. The cops aren’t coming for you if you don’t participate. What the State does do is disallows certain State income tax deductions when you file taxes if you choose not to have insurance. The rationale there is that if you do need medical attention while uninsured that the State ( the rest of us) will be picking up the tab for you as we’ve been doing all along with the status quo. So why should you get free medical and a a tax break?

<

p>

Here’s a helpful site Mass Health

to help you understand how this works ( especially the eligibility section).

Liberals want universal Health care ( read FREE) run by the incredibly incompetent and inefficient US Government. What makes Mass health so unique is that it is a means tested system that remains private .Those in the lower income levels get FREE medical and dental insurance. These are the people ie elderly, children, poor etc that really need help. People in higher income brackets pay an increasingly higher portion of their chosen plan based on their income level. There are numerous providers and numerous plans to select from including really cheap to really expensive depending on what coverage you want . Unlike a government “one size fits all”, you have a CHOICE.

<

p>

I would think that true progressives would applaud this program as it truly is a progressive system where the people least able to pay get free coverage while the people most able to afford it pay and subsidize those that don’t have the money with everyone ending up with health insurance.

and if I don’t pay my taxes [like, say, these wingnuts], the state will come after me with cops.

<

p>

I understand the rationale. The rationale glosses over the years when I don’t go to the emergency room — like the past 10. Nobody’s ever picked up my tab in my adult life but me, through the combination of insurance and private payment. In the years when I didn’t have insurance, I paid my doctor bills myself, thankyouverymuch.

<

p>

You completely dodged my central point: I don’t have a problem contributing to general welfare (and that ain’t free… the only ones who talk about free health care are conservatives claiming that’s what liberals are claiming). I have a problem with the government charging me a fine for not entering a contract with a private company. The tax differential is a fine, and if I don’t pay it, the cops will come for me.

<

p>

The system isn’t progressive — some of the cross subsidies include overcharging young [typically lesser earning] people to reduce the rates of older [typically higher earning] people. That slice makes it look flat out regressive. Progressives typically don’t support requiring middle income people to buy a service that helps pay the $800,000+ salary of CEOs.

<

p>

I don’t think the government is generally speaking “incredibly incompetent or inefficient.” It’s moreso when the GOP is in control it seems, but even then — VA, medicare, and medicaid are working far better than private insurance is lately. Besides, a national healthcare system would be a baseline — there’d be plenty of room in the marketplace for supplemental insurance, increased services, etc. Suggesting that choice would disappear is a flat out lie.

<

p>

Massachusetts, in the 19th century, required by statute for every resident to go to a private person or company and pay to receive a vaccine for smallpox.

<

p>

Why is it any different now, in the face of a significant state problem (i.e. individuals to go without health insurance) for the state to require a person to enter into a contract with a private company or person?

Two thoughts:

<

p>

1. This was a public health issue, not a public finance issue. The argument that requires everyone to buy health care isn’t one of communicable disease: it’s an argument about who should pay for emergency room visits. In that sense, they’re totally different.

<

p>

2. Seems to me that in the 19th century, Massachusetts should have paid doctors and nurses to run clinics, giving “free” shots to anyone who showed up, funding it with general tax revenue, and requiring everybody to get a shot. This way everybody gets access to the shot, those who prefer some higher standard of care can pay more for a private shot, and everybody else can go get the shot paid for with tax revenue. Nobody is forced to enter a contract with a third party, and public health is preserved.

<

p>

Sounds like a great recipe for today — and, in fact, I’ve argued that the US gov’t should socialize vaccines. Hep A, B, MMR, whatever. Pay a standard, fair rate per shot, keep national digital records of who has received the shots funded by the gov’t, and make the recipient pay $0.00. This takes a part of preventative medicine off the rolls of the insurance companies, could only increase the total number of people receiving the shots, reduces paperwork and overhead, and just plain makes sense. If an individual is willing to pay extra for some value added part [I don’t know — a waiting room with better magazines? Young, friendly, attractive nurses of both genders? Free breath mints?], that’s fine too. The socialized part would provide a minimum service: safe shots administered safely, paid for with tax revenue.

..but I’m with you 100% on the publicly funded vaccine idea.

<

p>

Wait! The universal health insurance movement isn’t about health? It’s about public finance?

<

p>

You mean AnnEm, et al who writes

painintheassedlytirelessly about Universal Health is really pandering for a financial fix not about the health of people? http://massdefendhea…<

p>

I don’t agree with her, but I do think she thinks, Universal Health is a health problem, not just a money problem.

<

p>

<

p>

Seems to me they ought to have done what worked because it was a time when barter-trade was active, and maybe a guy paid for a shot with a chicken.

<

p>

So, now, IF lack of health coverage is a problem (and, frankly, I have my doubts), and IF health-mandate works to ameliorate that problem, I’ll concede, libertarian principals notwithstanding, that it was a good idea. The value of the benefit offsets the cost of loss of a libertarian ideal. Besides, I don’t like it, I’ll move.

<

p>

I’m just as keen as the next libertarian that government leave me alone, and, it’s just as detestable for them to tell me to buckle up as it is for them to tell me to get health insurance from your boogie-man, the private company.

<

p>

But, on a who’s-more-intrusive-obnoxious-and-inefficient scale, government beaurocrats and the little Napoleons (is that redundant?) in government administrations, trump business every time. Been to the DMV lately? Care to join me in a visit to the building commissioner, zoning board of appeals, Mass DOR….

<

p>

Sorry, but your gentle lean toward a supposed libertarian principal that you can’t be made to contract with a private company simply rings hollow, if in the next breath, you agree with laws that mandate health insurance for students, fire insurance for homes and auto…

Wait! The universal health insurance movement isn’t about health? It’s about public finance?

<

p>

It should be obvious that the issue is primarily about financing. and secondarily about public health. As to the former, who is going to pay for what, and how. As to the latter, how is the community going to protect itself against you. If you don’t want to live in a community that wants to protect itself against your defalcations, you can feel free to leave.

<

p>

I’m just as keen as the next libertarian that government leave me alone, and, it’s just as detestable for them to tell me to buckle up…

<

p>

Whatever. If you don’t want to buckle up, or you don’t want to wear a motorcycle helmet, you don’t get to drive or ride a motorcycle on the public roadways. It really is as simple as that. You don’t have to right to either drive or ride a motorcycle on the public roadways. (Or, let me ask you this, do you believe that people with suspended licenses or with no licenses whatsoever–such as illegal aliens–have the right to drive on the public roadways?) I’ll give you a hypothetical. Let’s assume that you are married with children. If you get into an accident without buckling up or without wearing a helmet, such that they become public charges, it strikes me that the community has the absolute right to try to minimize to the extent that it can the likelihood that they become public charges.

<

p>

The problem that I have always had with self-described libertarians is that they believe that it is all about their rights, and they ignore the rights of the community.

<

p>

BTW, no, I haven’t been to the DMV in years. I renew everything over the Internet. Ain’t technology great?

I would be willing to let you gamble, but only if that to the extent you lose, you are liable for 100% of the actual cost of whatever medical care you require, plus collection costs, and that such liability were not subject to “hardship discounts” by the provider, discharge in bankruptcy, ordinary property exemptions, or limitations on wage garnishment.

<

p>

That way, if you gamble and lose, and require emergency appendectomy, which might cost of few hundred grand (even if you are young and healthy), you will actually pay your own way, thankyouverymuch, even if it requires forking over a third of your paycheck for the next three decades.

<

p>

Otherwise, you are specifically choosing to gamble with someone else’s money, which is why you are so willing to be careless with it.

How dare you. I earned too much to qualify for gov’t insurance, and too little to afford anything useful. Any significant procedure [appendectomy] would have forced me to file for bankruptcy even if I did have insurance.

<

p>

Given that, why on Earth would I have purchased insurance that I couldn’t really afford on top of rent and groceries on a part time job at Home Depot?

<

p>

That’s not carelessness. That’s a careful and rational decision based on sound financial analysis.

<

p>

But, you still haven’t responded to my concern. I’m not opposed to cost sharing. I’m opposed to being forced to cost share when some of that cost is massive salaries for private company employees or shareholders. The issue isn’t about health care at all — it’s about my government forcing me to do business with a private company. I think it’s unethical and immoral.

<

p>

Given that improving public health is a good thing and my stand on forcing the purchase of private health care, there seems to be only one choice for my frame: medicare for all, or some other form of nationalized health care.

<

p>

P.S. For the record, I have health insurance now. As a PhD candidate, I’m required by law to have it, and that’s a law that goes back to the previous Democratic governor of Massachusetts. Since getting a college education in Massachusetts is not a requirement [as opposed to, say, being alive] I don’t have a philosophical frustration with that law.

<

p>

Your decision wasn’t thoughtless or careless, it was considered: You opted to not maintain health insurance because the probability of a significant health problem or accident at your age was remote, and, if the unlikely did occur, society would bail you out.

<

p>

You, and all others who don’t carry insurance, are welfare recipients, much the same as subprime borrower would be considered welfare recipients if the government had some sort of bailout program for borrowers who default.

<

p>

That’s not a value judgment, just an accurate description, no?

Explain this to me please.

<

p>

If we greatly increase demand for an existing product how will this lower the cost of that product? I am missing something.

I saw a Romney ad yesterday where his latest brainstorm was to completly eliminate the capital gains tax … brilliant, why should we burden corporate execs with having to pay ANY tax on there stock option sales. I can not beleive he had the gaul to put out that ad …

Do the millions of Americans that own stock or the day traders know about this special exclusive perk for corporate execs? They must be pissed that they aren’t included amongst the nations few thousand capitalist swine corporate execs. I’m going to protest with the Commissar about this!

There may be tens if not hundreds of millions of ordinary people just like you and I who own stocks.

Unfortunatly for you, they hold them in tax defered retirement accounts making your point moot.

They will benifit from der Mittenfuhrers plan nada. zippo. Bet you are surprised huh?

DayTraders? lol please … if you realy cared about the fate of daytraders perhaps you should have questioned why the GOP stopped the plan to move the annual capital gain LOSS deduction up from the paltry 3 grand it has been stuck on forever. Most day traders will not live long enough to write off their losses.

Which brings us to the fortunate few who need further reward. Plus we needent forget commodity speculators who’s great service to our economy should not be forgotten

or taxes ..

Are short sales investments to you?

of short term and long term capital gains provisions and their effect on MILLIONS of Americans is spectacular. By all means! Hunt down and punish those greedy corporate execs, comrade. All 2400 of them! We can move 3 or 4 hundred indigents into one of their mansions in the Hamptons after they are sent to the Gulag . Ah, If only Lenin was alive to lead us!

The art of “borrowing” an asset that isnt yours and selling it into the open market under the assumption that the price will go down and you will be able to buy the asset back later at a lower price.

You know, like after 9-11 when all the major brokerage firms lined up to sell every security short at the opening bell the day the market reopened …..

According to your fuhrer, the art of selling something short is an investment and should not be taxed because investments are the driving engine of our economy.

You didnt mention commodity speculation, the art of buying paper contracts of commodities you never intend to see delivery of in the hopes that in some ponzi like effect the price will spiral and you will be able to dump your contract on the eventual end user of the product at some ridiculously inflated price…. Again the mittenfuhrer wishes to reward your service to society by waiving all tax on your efforts to serve mankind.

Wonderful plan …

There is a difference between a short sale and a short-term investment, so you guys are talking about entirely different things. What’s more, a short sale is a derivative investment just like any other hedge position, so I fail to see how this practice deserves any particular opprobrium. If I had equity investments on 9/10, I would hope that my investment manager would be smart enough to hedge against the giant hit that I would have been very likely to take when the markets re-opened after 9/11.

<

p>

Just so you know, to the extent that someone makes their living by simply flipping positions around (I doubt that there are very many such people), those gains are already taxed as regular income.

<

p>

For what it is worth, you’re right that cutting or eliminating the capital gains tax will mostly benefit those who have enough dough to exceed the contribution limits to tax deferred investments. I dount that this is only the hyper-rich, but certainly they are the wealthy.

<

p>

Nevertheless, there are reasonable arguments in favor of such a cut or elimination that extend beyond the Bob Shrum vision of the rich attempting to screw the “working man.”

I asked that “person” if he though “SHORT SALES” should be considered as an investment and taxed as such.

He spouted some crap about short term whatever and wandered off pretending not to understand the question.

No one wants to address the concept of why if you sell what I invested in, without my knowledge, why your potential profit from my failed investment should allow YOU to claim investment gain for preferential tax treatment while I, the actual investor, would have to eat my investment losses.

That perverts the system as far as rewarding investment, when you are actualy rewarding the destruction of investment.

A short sale has nothing whatsoever to do with your investment, any more than the value of my car does.

<

p>

It is a hedge position: a bet that the per-share cost of the stock will decline. If the stock rises, then the short seller has to buy high, sell low, and suffer a loss. I still don’t see why you have an issue with this.

<

p>

To the extent that you realize an investment loss, you can deduct it against any capital gains that you have, and if you have any loss left over, you can deduct $3000 of it from your ordinary income, and if there is any left over after that, you can deduct it carry it forward to next year.

It can also be a naked short. To find out how many are of which type check for open short interest, which these days is at a histoic high. You sure do have an anasteticly pure view of the markets, did you read about them in school or something?

Who gives a crap, other than that you appear to think that people who take such positions are fundamentally evil?

My original point, oh so long ago was this:

<

p>

It is NICE that as a society we should encourage investment into that society.

In that regard, it is OKAY that beurocrats grant investors preferential tax treatment.

But it really BLOWS that the same preferential tax treatment should be extended to activites of the type which can be epitomized by SHORT SALES.

<

p>

Isnt that a simple enough point?

Why does it get need to get so stretched out?

Do you agree with my point?

…if I was a full time day trader and somehow made a longterm living on buying and selling stocks that I held for one or two hours…or days, I should be able to do this tax free–which is what Mitt is saying in this ad–because why?

As in income? Like income tax? Where’s Tom when you need a dissenting opinion.

If you were to do that, your income from that activity would no longer be subject to taxation as a capital gain, but would be taxed as regular income. Same thing if you made a living long term by flipping real estate positions, which were the facts behind the case that I am thinking of.

Are you one of the REPUBL-ecans?

<

p>

The only INCOME that is taxed as INCOME are wages subject to reporting on form w2. You know, like the kind you and I who actualy work for a living get.

<

p>

Daytrading, speculating, and the like are reported as form 1099 “income” which are resolved in the form of capital gain taxes. They are not subject to income tax because some lame-o beouracrat decided that the proceeds were not income.

<

p>

Romney proposes to completly ELIMINATE the capital gains tax thus making all form 1099 income tax free.

<

p>

Great for billionaires, corporate execs and speculators.

As a plus you are now free to move money offshore at no risk of taxation … not a flipping penny.. whoo-hoo

It should not be a surprise to any of us that the corporate exec prefered choice of payment these days is in the form of stock options. Your dog pays more tax then most of these scum.

<

p>

http://finance.yahoo…

<

p>

15% should be repealed, capital gains should go back to being taxed as income IMO.

This is why I generally prefer liberal Republicans (would that any still existed!) to Democrats when it comes to tax policy. Democrats always have to answer to people like you screeching mindlessly about rich “scum.”

<

p>

Your income can be, as you rightly note, taxed as “capital gains” or “ordinary income.” You also correctly note that income from investments (setting dividends aside) are generally treated as capital gains, whether short-term or long. Not always, but generally. And such income is taxed at a more favorable rate than regular income.

<

p>

At some point, though, if the investment transactions become “frequent or subtstantial” the taxpayer ceases to be an investor and becomes a dealer. At such point, the IRS can deny capital gains treatment of the income, even if the income is generated from the sales of what is ordinarily considered to be investment property.

<

p>

So, your fictional day trader, or real estate speculator, who makes all of his or her income by buying investment property, holding for a short time, and then selling at a profit will have that income taxed as ordinary income, just like your weekly paycheck.

<

p>

In other words, just because the taxpayer tries to report everything on the 1099 form doesn’t mean that the income thereby reported is 1099 income.

<

p>

Reduction or elimination of the capital gains tax rate won’t change this fact.

<

p>

DayTrading is an occasional hobby to a lot of people. I do it from time to time. Quote from IRS regs all you want about what they CAN do but as long as the income shows up on a 1099 you will never get the dealer collar as long as you remeber not to touch the same security twice in a 30 day period. Thats a widely known fact.

<

p>

So do you wanna talk about the rich entrepenuers (scum 🙂 ?

<

p>

That is the real issue here, isnt it?

you will never get the dealer collar as long as you remeber not to touch the same security twice in a 30 day period

<

p>

I think you’re thinking of the wash sale rule, which states that you can take a capital loss as a tax deduction as long as you do not trade “substantially the same security” within 30 days in either direction.

<

p>

I could be wrong — well, actually, I know I’m right about the wash sale rule. But I could be wrong about whether there are any other 30 day rules that I’m unfamiliar with.

…how come hedge fund execs are only being taxed on Cap Gains rates (longterm cap gains at that) instead of income tax levels? Hedge fund managers are the uber day traders.

The only INCOME that is taxed as INCOME are wages subject to reporting on form w2. You know, like the kind you and I who actualy work for a living get.

<

p>

Just to remind you, “benefits” such as employer provided medical insurance are not reported on W-2s and are not counted as taxable income. Although they are income.

<

p>

At my last corporate job, we had the option of having our “co-pay” for medical insurance being reported as taxable income on the W-2, or not and receive a slightly reduced monthly paycheck.

What are those? Hmm .. I did read something about those once but I thought the book was fiction. Do people get benefits? lol 🙂

<

p>

They WHY have I been paying income taxes on a SCHEDULE C for over 20 years????

<

p>

News flash – Those of us WHO ACTUALLY WORK FOR A LIVING with 1099 self employment income get to pay the WHOLE 15.5% – no 7% sugar daddy employer for us, fool!

You dont count … next 🙂

…before you start your day job with the state or after you go home?

<

p>

BTW, yes paying the other 7% hurts, I’ve been there. And while I never did the math, reimbursing myself for every imaginable (and we all know how to imagine) expense, made up for that hurt.

Do the millions of Americans that own stock…know about this special exclusive perk for corporate execs?

<

p>

…that most people who own stock, own the stock through their IRAs and 401Ks, and, hence, will pay income tax at the regular (earned) income rates on withdrawal. Not cap gains tax rates or the special reduced rate for dividends.

<

p>

day traders is a bit more complicated, but from what I have read that is little different than casino gambling. Most of the profiting is by the brokerage firms.

His idea is that with more people getting into the insurance pool, you have more healthy people paying for insurance b/c they can afford it. Whether that works without significant mandates on someone … I just don’t think he’s really thought it through. If you can’t afford it, you can’t afford it; and for low-income folks, tax deductions may not mean all that much, since they don’t pay much in taxes anyway.

What Giuliani says, in and of itself, doesn’t make a whole lot of sense, but he does approach a question I’ve always wondered about tax policy.

<

p>

We’ve now got these medical savings accounts… do I have the right term? Money goes into it out of your paycheck, tax-free, and you can spend it on healthcare or lose it at the end of the year.

<

p>

This has always struck me as ludicrous policy. We’re expected to guess how much medical care we’re going to need during the course of the year? If we’re high, tough, if we’re low, we don’t get the full benefit.

<

p>

At the very very least, I think all healthcare expenses, including insurance costs, should be tax-deductible. 100%, completely deductible, no limit.

<

p>

And if we’re smart, we make preventative measures be a tax credit, or some such.

<

p>

This would be so much easier than playing Carnac with our healthcare expenses… why isn’t this the way things work?

I could see getting it back at the end of the year, after having taxes taken out. Then, they get the float but not the money.

<

p>

We went through this exercise with my wife. How much do we take out? Enough for her regular meds and regular doctor visits. Will she likely spend on something else? Regrettably, yes. Are we willing to gamble that she will? Nope.

a Danish doctor article you reference did NOT invent brachotherapy . As a prostrate cancer survivor that had this procedure, I believe I’m qualified to comment on this life saving procedure. What the Danish doctor DID do was develop a procedure that used incredibly sophisticated AMERICAN invented ultrasound equipment to correctly place the radioactive seeds such that the radiation was uniform.

<

p>

IMO, your attempt to diminish the technical excellence of American medical technical savoire faire by implying that a European “invented’ brachotherapy and that American medicine is some how second rate is intellectually dishonest.

<

p> I think that people world wide would agree that the most advanced and technically sophisticated medicine in the world is right here in the good old USA. When the richest people need a heart operation, the first thing they do is board a plane for the United States…probably Boston for ‘the best health care in the world”

Charley never said the Danish doctor invented brachytherapy.

<

p>

Charley said, Giuliani’s prostate cancer treatment was invented by … a Danish physician. And by your own words, what the Danish doctor DID do was develop a procedure […] to correctly place the radioactive seeds.

<

p>

That sure sounds like an invention to me.

<

p>

And Charley certainly never said or implied that American medicine is some how second rate. That’s entirely your own willfully skewed reading. Charley was merely pointing out that American healthcare is not always the best in the world.

<

p>

To believe otherwise is just blind, ignorant “patriotism”.

and America sucks for the new left. I’ll try not to brag about my country in the future. meanwhile, if you should need a a high tech medical procedure in the future, maybe you might want to hop on a plane for Cuba? Michael Moore says their system is far better than the USA. Here’s a nice preview of your room Cuban hospital

Enjoy!

Boy, Tom, I’m starting to get the impression you don’t give a crap about what people are actually saying, as long as you can twist their words to suit yourself.

<

p>

Did you notice that I put “scare quotes” around “patriotism”? That means that I wasn’t using the term seriously. I don’t consider “my country, right or wrong” to be true patriotism. A patriot is not just in favor of their country, but is actively in favor of improving their country.

<

p>

People like you who say, “my country right or wrong” are giving up on the entire second half of that. You’re doing nothing to improve this country. You’re just saying, “We’re Number One! And that’s good enough!”

<

p>

Furthermore, you have absolutely no inclination to actually addressing the topic. Did I ever say or imply that our healthcare is the worst in the world? Did I say that Cuba’s was better? What the hell is the point of bringing that up?

<

p>

My point, which you don’t bother to even look at, is that maybe, just maybe, relevant and revolutionary therapies might be invented outside these 50 states, and that stating that fact is not profanity.

<

p>

Do you deny that the Danish doctor made a huge improvement to brachytherapy? Would you rather use old-school brachytherapy where they guessed at where to place the “seeds”, and if parts of the prostate got too much radiation or too little, oh well, them’s the breaks?

<

p>

America isn’t always the best. Stating that fact and addressing it shouldn’t be dirty. I want this country to be the best, but the first step is to admit when and where you’re wrong.

<

p>

Are you willing to address this country’s failings? Or is your response to this going to be “LALALALA I CAN’T HEAR YOU LALALALALALA”?

“People like you” as you say, seem to always want to tell us how bad America is and how wrong it is. How about telling us about how great it is? Tell us what’s right about it.

If America isn’t always the best why don’t you move to Venezuela , Cuba or some other socio communist utopia and really get a load of what a lousy country is all about?

Please, spare us your whining and pompous lectures. What the hell have you done for America lately or ever for that matter except bitch about it. Grow up.

Your answer was, in fact, “LALALALALA I CAN’T (don’t want to) HEAR YOU LALALALALA”. Your assumption that I’ve never done anything for this country is, quite frankly, ludicrous, as is your statement that I should move to Cuba simply because I don’t think the USA is 100%-perfect-could-not-possibly-be-improved.

<

p>

I’m done trying to talk to you, Tom, and I think this site should be done with you.

<

p>

I’d like to suggest to David, Charley and Bob that “Toms opinion” get the same treatment that other trolls (like Republican Rock Radio Machine and SchoolZombie’87) in the past have received.

<

p>

Make no mistake; I do not make this request lightly. There are lots of right-wingers here for whom I have a good deal of respect (as should we all), even while I usually disagree with them. (Gary, geo999, PP, I’m looking at you.)

<

p>

Tom is not one of these folks. Tom is clearly not here to participate in meaningful conversation; he just wants to stick his fingers in his ears and jump up and down shouting as loudly as he can.

intelligent and open to discussion and dissenting opinion than some of the closed minded echo-chamber crowd that seems to do the most of the posting here. It’s sad to see that some individuals are so closed minded and opinionated that as soon as they are confronted by a rational ,sans ad hominem , and fact based counter point, that they demand that such a difference of opinion is immediately stifled, censored and ostracized to preserve the purity of their mono-view goldfish bowl. Don’t you get bored with sixing (6) the “correct posts” and trashing dissenting opinion|? How juvenile?…how sad?

Grow up.

What’s rational about suggesting I move to Cuba?

<

p>

What’s rational about ignoring every point I make?

<

p>

What’s rational about telling me I’ve never done anything for this country when you don’t know who I am?

<

p>

Fact-based? In this entire thread you have not mentioned one single fact. What’s rational about that?

<

p>

Pop quiz, Tom. True or false:

1) America is always the best in every conceivable department; no country can ever out-do us at anything.

<

p>

2) Being the best at something means you should stop trying to improve or that you can’t improve.

<

p>

3) If you answer “false” to either of the above, you should stop whining and move to Cuba.

<

p>

4) It’s possible to love something (or someone) and at the same time recognize that it (or he or she) has flaws.

<

p>

Just answer these questions and we’ll see how rational you are.

…in lost revenues? But I can’t go over to Rudy’s site to see…besides those are details that Republcians don’t like to talk about.

Really – how much WILL it cost? And like Charley says, principal beneficiaries are on EITC now!