It’s hard to pin-point a singular reason why income is stagnant in this country, but I think it is safe to say that economic gains in this country are not being equally distributed.

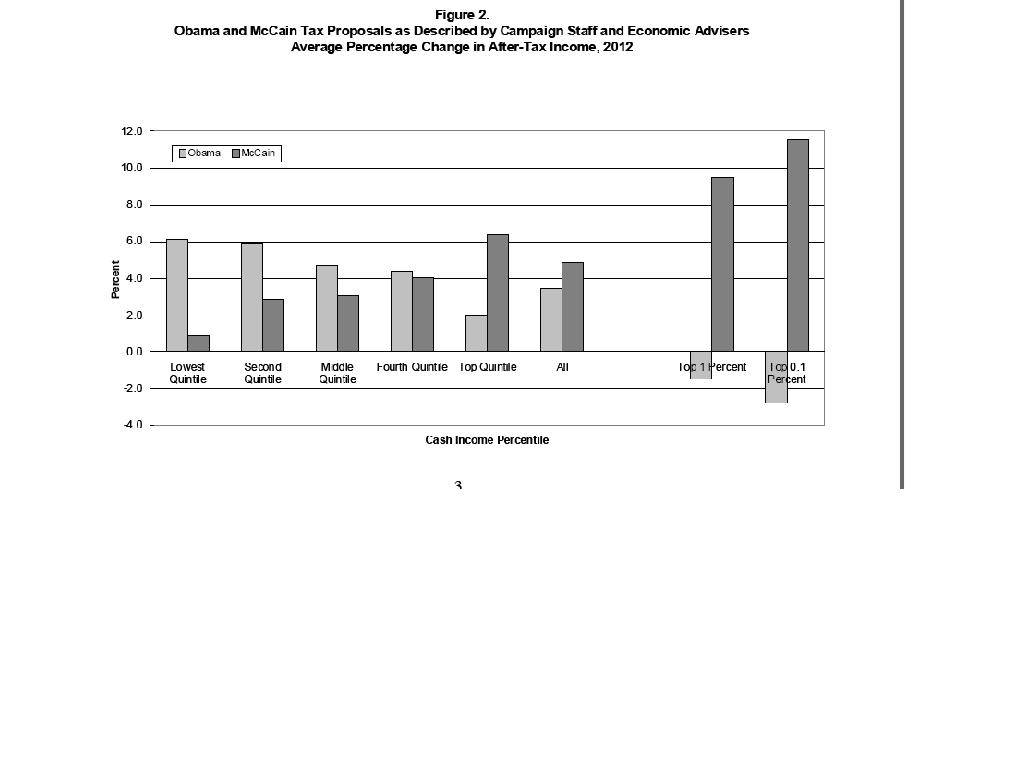

Tax policies favoring the rich compound this effect. Check out this graph from the Tax Policy Center to see what’s at stake in this election:

Both candidates are proposing big tax cuts, but whom those cuts favor is as clear as night-and-day.

Please share widely!

…and certainly worth a thousand words – or dollars!

It appears that median income dropped following each of the recessions following 1967, then rebounded. Median income is now rebounding since 2005.

<

p>Your graph doesn’t substantiate your point that unequal income distribution is contributing to stagnation.

where’s friggin perot when you need him?

My opinion. What’s a few trillion among friends.

<

p>Each are large numbers, which is why the media uses them like a bad lightbulb: to shock rather than illuminate. The effect of the sizeable debt has so far been mundane as long term bond rates indicate and debt as a function of GDP isn’t scary. That is, you can still buy a house on a 30 year fixed with historically low rates; the federal borrowing hasn’t depleted available funds to be loaned.

<

p>I think the national debt issue is currently a red herring and will only become important in a few years or so when social begins to take in less than it spends. i.e. when the general treasury loses its SS subsidy, politicians will worry.

<

p>I think the important major economic policy difference is this. Mr. McCain seeks a reduction of government revenues over 10 years and Mr. Obama seeks to increase revenues.

this is the first time that real median HH income actually dropped from peak to peak. Income is lower in 2007 than it was in 2000.

<

p>So if the economy grew during this period, and median income did not, where did all the income go?

<

p>My guess- a.) Overseas b.) in the bank accounts of the extremely wealthy

<

p>Feel free to draw your own conclusion…

I find myself less and less partisan as I see politicians claiming credit or casting blame based on statistics, when the politicians likely had little to do with them, yet we play along. Never quickly attribute/blame a politician, because likely he’s not the cause; he was just in the chair when the thing happened.

<

p>No question the statistic is meaningful so, where’d the money go? i) outside the median (upper class); ii) overseas (not a bad bet considering the trade deficit); iii) statistics.

<

p>Statistics via the Boomer effect: The peak earning age is the 45 to 54 age group. There’s fewer of them now than there were then, therefore median $$ dropped.

<

p>

<

p>Enter the Gini coefficient, a statistic that measures dispersion. In this example as a measure of inequality of income distribution or inequality of wealth distribution.

<

p>First, the graph, with the U.S. index generally trending upward through Democrat and Republican adminstrations alike (i.e. more inequality) from 1967, its first year reported, peaking in 2006 and down slightly in 2007. I don’t see any particular noteworthy trend that separates 2000-2007 from the balance of the data. I must therefore dismiss the notion that the median income stagnation, did NOT go disporportionately go into the pockets of the wealthy, or if it did, it went no faster than in prior 40 years.

<

p>That leaves the two most logical conclusions: demographics (i.e. the statistical boomer effect above) and overseas, which at this point seems to be compelling.

<

p>Now with respect to the overseas shipment of dollars. I think the Median income doesn’t tell the whole story. Lots went overseas, and income stagnated, but purchasing power increased or didn’t decrease proportionately principally because of the low price of imported basic goods. (i.e. the Walmart effect.)

<

p>I’m left with demographics to best explain the bulk of the 2000 – 2007 data, but I hear on good sources that The Economist is working on a couple of good studies to analize this very thing.

<

p>But note, if I’m right, the trend will logically continue at least for the next 15 years as the boomers age out of the work force. Compound that with i) the absence of a trailing large population bubble, and ii) the payment of $$$ entitlements boomers will be whining for and receiving, and it doesn’t paint a nice picture for the US economy for the next decade.