I’ve done a significant update below – I had the tax effect of McCain’s “reform” of the tax code exactly backwards, but now I’m sourced back to McCain’s top economic advisor, Doug Holz-Eakin.

Here’s a comparison of the two plans from the Economic Policy Institute (a nonprofit, nonpartisan think tank that promotes strategies to achieve a prosperous, fair economy):

Senators John McCain and Barack Obama have presented very different plans to reform health care in the United States. Last week, the Urban Institute/Brookings Institution Tax Policy Center (TPC) provided what appears to be the first evaluation of each plan’s effect on costs and coverage outcomes.1 While the TPC findings are preliminary, there is a wealth of information contained in them; some of their implications, however, may not be immediately apparent even to those relatively well-versed in the U.S. health care debates. The punch lines of the TPC analysis can be stated relatively simply:

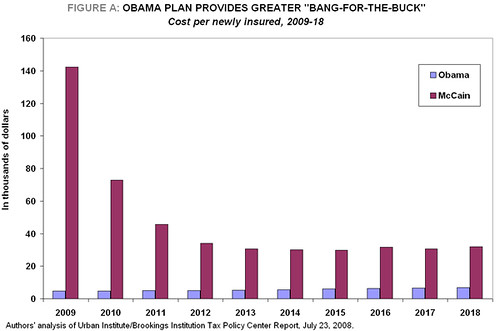

* Efficiency. Over the 10-year period analyzed by the TPC, Senator Obama’s plan provides far greater “bang-for-the-buck,” spending far less per capita for its coverage of the uninsured population (see Figure A below).

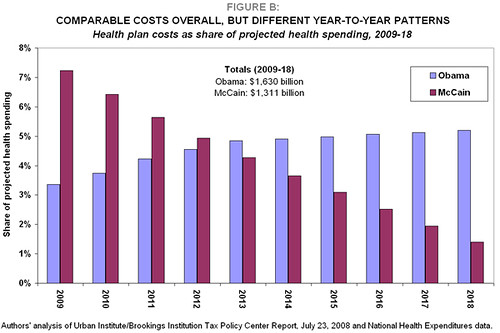

* Cost. The costs of the plans over the 10-year period are in the same ballpark: the Obama plan costs roughly $1.6 trillion, while the McCain plan costs $1.3 trillion (the Obama plan spends roughly 20% more than McCain’s) (see Figure B).

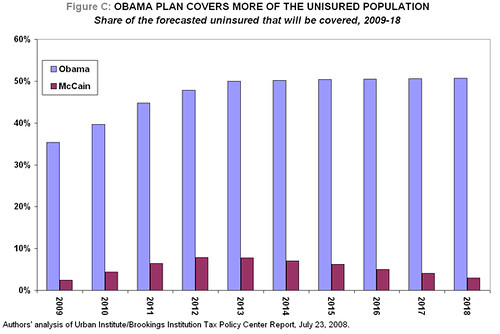

* Coverage. The Obama plan makes a much bigger dent in covering the uninsured population. On average over the 10-year period, the Obama plan covers over 47% of the forecasted uninsured population, while the McCain plan covers less than 5% (see Figure C).

There’s lots more at the link, please go read the whole thing.

To my mind, the worst feature of McCain’s plan is that he would make folks who were lucky enough to get health coverage from their employers pay taxes on it, at the same time as giving everyone a tax break to allow the purchase of insurance.

According to Holtz-Eakin this does NOT mean that the employer will no longer be able to deduct health insurance costs, as I had previously guessed. Rather, it means that the employee will now have to pay taxes on health insurance benefits provided by the employer.

Source: Don Pedro, Economists for Obama

It’s a disincentive for companies to offer insurance to their employees. Young people will opt out of plans, which will leave a smaller pool of older folks, so their prices will rise – this in turn will cause more members to drop out, exacerbating the problem. Eventually everyone will be forced into the private insurance industry – good luck getting a policy you can afford if you have any kind of pre-existing condition! And I do mean any kind – a good friend of mine broke his hip when he was in his twenties, and he can’t get a policy these days.

Have at it in the comments, folks…

I reread the tax thread and it looked like all the comments were about taxes. So I’m wondering whether you objected to putting my own two-cents worth regarding a sales tax rather than talking just about the McCain and Obama plans.

<

p>On this issue I support single-payer, but neither candidate is proposing it so I won’t get into it if that is not the intention of this diary.

One of the local right-wingers posted an attack on Deval Patrick at the bottom, that was the only “worthless” ratings in the thread, that’s what I was referring to. I saw your posts about sales tax – while it was off-topic, I participated in it, it was fun! Call me a geek, I like discussing tax policy – health care too, in my latest diary on the issues (OK, cal me a diary pimp, too…)

Is there a specific funding source for this?

Or for McCain’s plan?

<

p>Both plans will cost money, as described above – McCain is at $1.3 trillion while Obama is at $1.6 trillion. Yes, Obama’s plan is more expensive, but only by 20% or so, and it packs a much better wallop for the dollar.

Obama’s is better because it does not basically encourage business to drop employee care.

<

p>But Obama has said he supports pay-as-you-go. For this to happen, there needs to be funding.

Please explain how McCain’s tax plan came out ahead in that discussion.