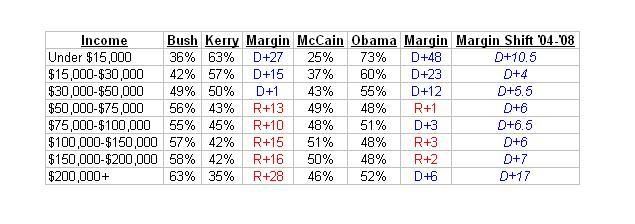

This chart shows how well each candidate did in the ’04 and ’08 election in terms of raw percentages, and the margin of victory within each group. The “Margin Shift” category indicates the vote shift from 2004 to 2008 (e.g. a 21-point margin increase going from D+27 to D+48 means that the Democrat gained on average +10.5 points and the Republican lost -10.5 points).

Clearly, Obama did better in each income group than Kerry — not surprising, since he did better than Kerry among voters overall (about 5 points better, on average). However, there are a couple of clear outliers here, in the very lowest and very highest income brackets.

The +10.5 point shift among those making less than $15,000 is not too surprising, since many of these are likely students or otherwise previously unregistered low-income voters that the Obama campaign targeted. But notice the overall trend here — as you move up the income ladder, Obama did better and better in comparison to Kerry in ’04. It culminates in a +17 point shift among the richest ($200K+) voters. Obama actually won a majority of these voters, whereas Kerry lost them 35%-63%. I find this remarkable.

This is made all the more remarkable when you consider that Obama made no secret that he expects more of the tax burden to be shouldered by those making more than $250,000 (as Republicans would argue, he would “spread their wealth around”).

Indeed, you might argue that Obama made the most gains among people who will gain the least from his tax plan and the fewest gains among those who will benefit the most. Many of those in the lowest income bracket are likely either students, seniors, or non-workers who will see little or no tax cut. Those in the $200+ bracket will see a tax increase. Those squarely in the “middle class” would see most of the gain, and yet Obama made fewer gains in this group.

This is not to say that Obama did not do well among “middle-class” voters. In fact, he did better than Kerry with this group. But given that Obama stressed the middle class whereas Republicans claimed Obama was a “socialist” Robin Hood who would take from the rich, you would expect Obama’s gains (as compared to Kerry) to be concentrated in the middle income brackets. Yet the opposite occurred. It might be accurate to state that the richer one is, the more likely you were to switch from Bush in 2004 to the allegedly “socialist, redistributionist” Obama in 2008.

I wonder if this marks (as I suggested above) an important shift in American politics going forward. Is it the case that the Republicans’ emphasis on taxes just doesn’t fly as such a critical issue anymore? Do wealthy Americans really buy into the idea (stated during the campaign I believe by Biden and maybe Obama as well) that they have a patriotic duty to pay more taxes? Or are taxes still an issue for them, but the salience of the issue is now so low (compared to other issues) for them that they are willing to vote for a candidate who promises to tax them more heavily?

I ask these questions because I have no idea, and it would be interesting to hear what BMG’ers think. I really find the above exit poll results remarkable, and it suggests to me that tax reform in a progressive direction will face considerably less resistance than in the past.

They might have started to feel a little guilty with their high salaries and capital gains and don’t know what to spend it on anymore, and, noticing the shape the country is in, were probably wondering how come the government is taxing them more. Among the Hollywood rich, they must be looking forward to being recognized for coming to the country’s rescue.

making up, what, a whopping 0.01 percent of the electorate? Right above the smaller, and slightly more conservative, “professional athlete” demographic.

I missed Bob’s earlier post, which highlighted this fact about income. So no disrespect to Bob meant here by not referencing his very interesting post from Thursday, which, as he notes above, contains nifty graphs and analysis about Tuesday’s election.

I was just trying to point people to the interesting charts and analysis by Prof. Gelman. They certainly weren’t my insights 🙂

<

p>Anyway, your post has additional interesting data. Just what one wants.

Upper middle class earners can probably figure out that their prosperity is tied to the performance of the economy as a whole. And many probably remember that Clinton’s policies – and higher marginal tax rates – in the 90’s delivered broad-based prosperity.

Without it, I think he still would have won, but it would have been a nail-biter.

<

p>Here I believe you’ve fallen prey to a Republican meme. Their idea is that everyone is “self-made” and government should stay out of the way. If someone’s rich, it’s because they personally merited that.

<

p>In reality, we exist in a system, and the rich are the winners in that system – the ones who have gained the most from its (in most cases) proper functioning. That is why they ought to pay a much higher share of taxes, and that is also why they have the most to gain from success.

<

p>As Warren Buffett wrote in an op-ed a few years ago (paraphrased from memory): “My secretary has a talent for organizing paperwork, and I have a talent for capital acquisition. If we were born in a dysfunctional African country, my talent would not be worth any more than hers. America gets a greater share of the credit for my wealth than I do.” (He went on to point out that, thanks to the lower capital gains tax rate, he pays a lower share of his income in taxes than his secretary, which is entirely unfair)

It’s not clear to me at all why the over $200K crowd voted Bush then Obama. Various ideas come to mind:

It’s hard to say what caused this shift. Without asking these voters, we can only guess.

They might have started to feel a little guilty with their high salaries and capital gains? Who are you?? You think if someone works hard, takes risks and gets rewarded for it they should feel guilty? Please. These people pay A LOT in taxes and, according to the stats in this blog, are willing to pay even more. We should all be grateful they are so ambitious… and patriotic.