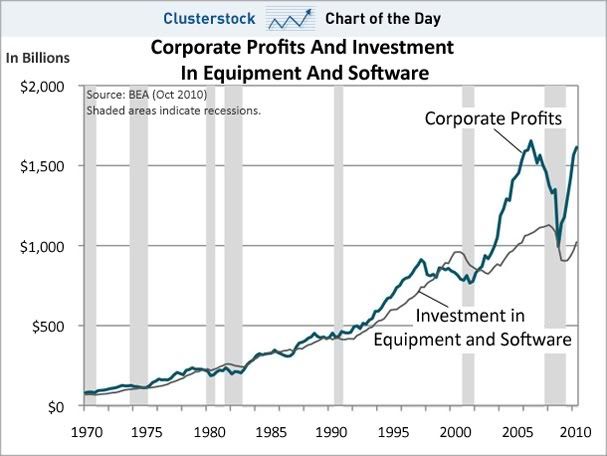

While I don’t doubt the sincerity of honest conservatives who support Corporate America presuming that it supports the US economy in its own best interest, the facts are otherwise:

Despite cheap credit and a profitable business climate, what corporations are not doing is investing…

Please share widely!

If you missed it, the New York Times had this related story (Cheap Debt for Corporations Fails to Spur Economy) last week.

<

p>

When corporations were worried about future taxes, regulations and the economy.

<

p> BTW one company did this before the current downturn, that firm is FORD who survived without corporate bailouts.

Ford, having major profit/loss difficulties before the Great Recession, cut back costs and dividends, invested in plant infrastructure, and took the long view.

<

p>Hence the company did not need federal support to survive.

<

p>Your premise that corporate plans are based (largely) upon “future taxes [and] regulations” is great spin, but, given the actual structure of the US Tax Code as applied to corporations, has little to do with corporate decisions over the past three decades, where abandonment of fiduciary responsibility on the part of Boards of Directors and institutional investors alike created the mess.

<

p>Specific to American automobile companies, another problem was the rise of corporate leaders from the design, finance, and marketing divisions supplanting automotive engineers in the executive suites (and making engineering decisions for which they had little or no qualifications).

<

p>As Adam Smith pointed out in “The Wealth of Nations” unregulated markets always self-corrupt and auto-destruct.

Instead they have to compete with GM who is subsidized by the US government. So Ford played the game correctly, and the US government rigged the game.

<

p>Both GM Executives and Workers dragged the company down.

Ford still has family responsibility. I doubt if any of the Ford family wants to be known as the ones that ran the company under. Other companies are out to chase the quarter earning and no long range goal is needed. The execs hope to be retired by the time of collapse. Quick buck is more important than peer rating.

Companies held by families have a much longer time horizon. They put up with the ups and downs.

Inheritance taxes don’t apply when any competent 3L can create a family trust – if that trust is created under the public auspices of a practicing attorney.

<

p>The issue is not ownership of money, but control, and estate taxes only apply to “ownership” by the deceased. When the trust has “ownership”, control passes to the heirs without dilution.

<

p>The concept of “Death Taxes”, while good and effective spin, is legally and financially fraudulent – again presuming a marginally competent estates and trusts attorney.

Then why are America’s wealthiest families so adamant about repealing it? If it can be so easily circumvented, they shouldn’t care.

…and progressives are lousy at long-term appeals to the larger electorate in a populist political climate.

<

p>Practical politics at base are appeals to emotions, and the Democratic Party as a structure often works as a Republican outreach mechanism because it doesn’t address the legitimate concerns and insecurities underlying such things as the Tea Party movement.

<

p>Hence the success of politically effective, if factually false, concepts like the “Death Tax”.

<

p>It plays into accurate beliefs that most citizens are ignored by American institutions – including government.

<

p>Right-wing message really hasn’t changed during my lifetime; it succeeds not because the larger electorate is more conservative, but because it’s anti-progressive – the two are not synonymous.

<

p>The modern Right is a parasitic, plutocrat-funded, opportunistic anti-conservative structure that preys on legitimate fears. It can be checked only if Democrats create an enduring, self-empowered grassroots base, to replace the one it abandoned forty years ago.

From a NY Times business column by Catherine Rampell:

<

p>

(at the moment) are unlikely to increase employment (or help the economy). Caught in the paradox of thrift, demand is low. We need to stimulate demand.

<

p>That’s one reason the Beacon Hill Institute’s recent rehashing of the Laffer Curve is stupid. Other reasons might include their failure to seriously discuss what 10,000 (!)public sector jobs we would lose, the quality of 27,000+ jobs Question 3 would allegedly create, and extreme pressure the cuts would put on property taxes. But hey, why sweat the details? The market will provide.

Possibly this reflects a growth in the profits accruing to the financial sector whose profitability doesn’t require much in the way of equipment.

<

p>Furthermore, the growth of that sector has been hard to justify on the grounds of social good. Inventions like mortgage-backed securities and credit default swaps have been good for the economy precisely how?

Banks and Financial institutions are doing quite well. They can borrow money at almost 0%. The rest of us, not so good.

has been steady and preceded the financial crisis.