A new paper released today by EARN (the Economic Analysis and Research Network) looks at what states can do to create strong state economies that support high wage jobs for their people. Is it low taxes, well educated workers, or something else?

When we look at data from across the country, two clear conclusions emerge:

- There is no correlation between the overall level of taxation in a state and the ability of the economy to support high wage jobs (see figure A in this post);

- There is a very strong correlation between how well educated a state workforce is and the ability of the economy to support high wage jobs (see figure B).

Looking at this graph of overall tax levels and median earnings (a measure of wages that includes both hourly and salaried employees) one might suspect that there are just too many differences between states to see a clear correlation on any one variable.

It turns out, however, that when we look at how well educated a state workforce is we see an extremely strong correlation with economic strength: states with a well-educated workforce have higher median wages than states with a less well educated workforce.

Overwhelmingly, high wage states are states that have a well-educated workforce. We also see that there are virtually no outliers. There are no states with a well-educated workforce that don’t have relatively high median wages, and there are no states, with the exception of Alaska (which has a resource based economy very different from the rest of America), that have high wages and a poorly educated workforce.

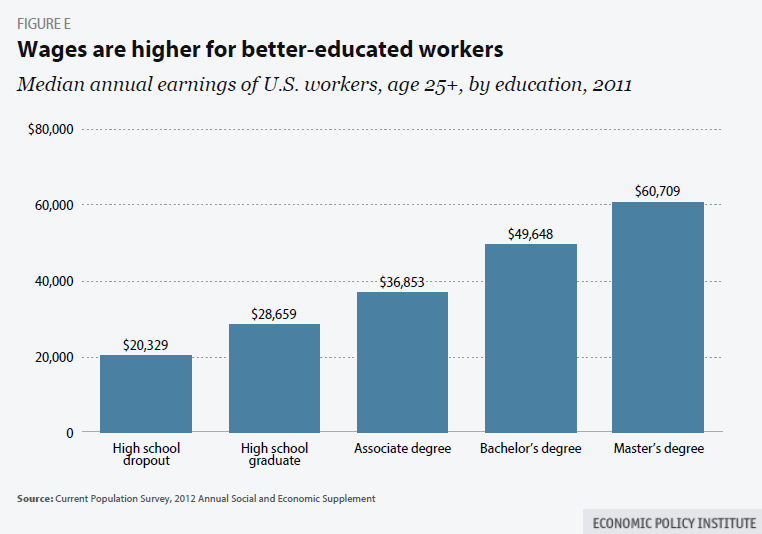

To some degree this finding is simply stating the obvious. We know that individuals with higher levels of education will generally earn higher wages, and it makes sense that what would be true for each worker would be true for the workforce overall.

In our modern economy, employers who pay good wages generally need well trained and better educated workers. By improving the overall level of education of its workforce, a state can increase the productivity of firms in its economy. That allows firms to increase both profits and wages. As obvious as this fact is, education often receives less attention in state economic policy discussions than do taxes, regulations, and business incentives. Why is that?

In part it could be that states seek quick fixes and building a well-educated workforce can require a long term commitment, but there’s another reason why education may not be receiving the attention in state economic development debates that the data suggests it should: the pattern we see today, where there is an extremely strong correlation between the level of education of a workforce and the wages of the people in that state, is relatively new. As recently as the late 1970s, many of our highest wage states had very few workers with a college degree:

In the 70s, states with heavy industry and strong unions had high wage economies with good jobs for many workers regardless of their level of education. But in today’s world, states that want to build strong, high wage, economies cannot ignore the importance of providing all of their people with the opportunity to receive a high quality education (and the related supports that all children need to reach their full potential).

At the national level there are a number of policies that can raise wages across the board: appropriate fiscal policies during periods of underemployment; equitable labor laws that allow workers to organize; trade policies that aim to raise living standards in the US and abroad; and regulatory policies that protect our economy. But very few of these tools are available to state governments.

States can enforce labor standards—like minimum wage laws and sick leave provisions—that make life significantly better for lower wage workers and have a modest positive effect on the overall economy. But along with those steps that can improve the lives of working people immediately, states can build long term economic strength by investing in strategies that improve the education, skills, and productivity of all of their people. What the best ways are to achieve that objective is a question with no one simple answer. Finding good answers to that question is likely the most important thing state governments can do to build strong, high wage economies, capable of delivering broad based prosperity.

As usual, your research is excellent. I look forward to drilling down into this report more.

The data presented makes it even more urgent to support President Obama’s proposals to make college education more affordable. I predict that the devil will be in the details of the proposal but let it not be in protecting the status quo.

The measure of “have” and “havenots,” is clearly demonstrated in access to education. Answers include (yet, are not limited to) reducing financial barriers so that struggling middle class families can still achieve their dreams of pursuing a college education, careers, service and prosperity.

This body of research is fuel to contact state and federal legislators to push needed changes. Or sign onto Senator Karen Spilka’s (candidate for MA-05 Congressional District) petition to support President Obama’s proposals here.

I just re-read my post (for the inevitable typos) and decided with final conviction that Senator Karen Spilka will have my support in the CD-05 race.

Yup, that’s it.

First, great diary, very informative. Couple thoughts, perhaps just spitballing here but want to put on the table.

1. Seems that most of the states with the lower salaries are “right to work states” where as MA has prevailing wage, where flagmen can earn $32 hour. The largest employer in MA is the state itself. Does the average salary include both public and private sector workers? If so, it would be interesting to see what the disparity is between the hourly wages of just private sector workers VS degree of education.

2. Don’t forget, the cost of housing impacts wages. If a couple in GA is making $35K each and a couple in MA is making $45K each, who is better off? So I would include, along with taxes, cost of housing, to give us an even more accurate picture.