President Obama took one step closer to being a transformational president, just like Ronald Reagan is considered by most objective historians.

Obama made a serious proposal on Thursday, trying to bend the cost curve of higher education. One of them is to rank each university based on “tuition, graduation rates, debt and earnings of graduates, and the percentage of lower-income students who attend”. Ratings will be tied to financial aid, the higher a college is rated, the more financial aid is available to the student.

Other ideas Obama suggested is having colleges offer more online courses, freshman students receiving credits for subjects taken in high school, and even three year bachelor degrees, instead of the traditional four (Sorry Stomv, Obama agrees with my idea).

Pell Grant disbursement will be changed from a lump sum, to over the course of a semester, tracking the students progress toward a degree. And upon getting a job, repayment is based in ones income, 10% of disposable income.

All these ideas sound reasonable and its an issue most Americans will face, whether you are a student sending out applications for acceptance, or parents applying for Pell Grants or stroking a check to one of these colleges. Republicans should embrace these ideas, add a few of their own (I have one or two), and get a bill to Obama’s desk ASAP.

is a joke. This is another example of the neo-liberal canard that competition–this time between between colleges on a rating system generated by the federal government–will lead to lower costs.

I’m all for healthy competition when customers can make informed choices, but like health care, it’s very hard to make an informed choice about higher education. There are just too many variables that colleges can’t control. Families don’t decide on college rationally. As Daniel Luzer writes,

In other words, demand is driving costs. Although I’m a public college guy from Holyoke Community College (’82) to UMass undergrad (’86) and grad school (’92, ’08), I watch and help kids make decisions about college every year. In my suburban school system, public schools are looked on as second or third-rate. Families pay lots of money to send their kids to second or third-rate, four year schools for irrational reasons. One exception that proves the rule is one of my students who was accepted to Johns Hopkins (tops in his planned field of study) and Penn State. He would have gone to Johns Hopkins without much financial aid rather than attend Penn State on a full scholarship. His parents strongly encouraged him to attend Penn State. He has and he is glad he did. Not all families are as rational as his, however, and more information isn’t going to change their basic irrationality. As is noted in Washinton Monthly,

Creating a ranking system will more than likely create a system of perverse incentives as colleges lobby and then game the system. They always do. You think Harvard or its applicants is going to give a crap about how it’s rated? Will it matter if it’s rated lower than Duke or Yale? Of course not.

The brunt of Obama’s plan will all fall on the shoulders of smaller establishments, primarily public colleges, which will take the brunt of the abuse. The problem of affordability at these schools has as much to do with rising costs as decreasing state aid. Again the Washington Monthly,

Public colleges will be pressured to lower costs by increasing online coursework. Again WM,

Of course, Obama hasn’t thought of this. He’s not that deep on the issue.

I always thought the main driver of spiking college costs over the past few decades has been the Pell Grants, which the government gives these universities an endless pool of money, every year. Do we just offer Pell Grants to public universities at in-state rates? If one chooses a private univerisity like BU at $56K, the max one gets is $25K which is the UMass rate (just estimating here). Or if a MA student is accepted to UCLA, the max is still $25K, the student finds the difference if one chooses to go out of state (parents, scholarship, etc).

Or the Feds negotiate with these private universities like our health insurance company negotiates rates with the hospital for preferred rates and costs.

My family members either joined the military or ROTC to offset the cost of higher education. Other than that, I don’t know what else can be done.

about the burden of Pell Grants being the main driver of college costs. I know Heritage is pushing the idea, but I’m not finding it mentioned elsewhere. Frankly, it doesn’t make sense.

A Pell Grant gives a student $5,550 a year. Individual colleges may give grants and there are some scholarships out there, but for the most part, people are footing the bill with college loans. My niece is two years out of college and she had $125,000 in loans. My sister refinanced her house and paid $50,000 or so on it, but that’s pretty much how college is paid for.

Tuitions at very competitive private colleges to explode. They just don’t see that many Pell Grants. My wife graduated from Mt. Holyoke in 1987. She paid $13,500 in tuition then, with probably another $5000 for room and board. Tuition is now $41,270 a year. Add it’s $12,000 for now and $5000 or $6000 really doesn’t make a difference. Anyway, I don’t think it’s financial aid driving college costs so much as it is the fact that people are willing to go into debt to pay for it. The choices that parents and kids usually have more to do with how they view themselves, particularly from a class point of view, than cost efficiency.

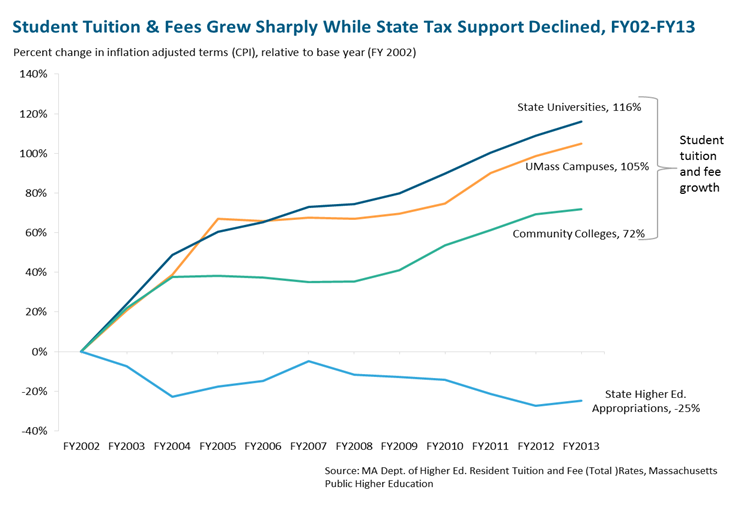

On the other hand, in the last 5 years tuition and fees for Massachusetts public colleges has increased 34% as an average. The MBPC has a nice graph illustrating trends over the last 11 or 12 years:

I was public college all the way: Holyoke Community College (’82), UMass undergrad (’86), and grad (’92, ’08). I ended up with $5000 in loans because I lived on campus for two years. My daughter starts at HCC this year. It will cost her $3000 for the year because she’s on my insurance and received the tuition waiver (a whopping $288) for high MCAS scores. She took out a loan, which we hope she won’t have to use up. The funny thing is, every time I talk to a recent college grad they tell me they wish went to community college first. A couple of years there would save them $50,000. They could still get accepted and transfer to competitive schools. But it’s a prestige thing. How many 18 year-olds understand what $50,000 means?

I’m reminded of how the Earned Income Credit, for example, enables Walmart to pay lower salaries. Flipping it, the economics of the Pell Grant and low student loan interest rates would naturally nudge upwards the cost of college. If students get more aid, some proportion of that aid is going to get eaten by colleges and universities. When you shift the demand curve, prices go up. The conservative critique is not without merit here.

Nonetheless, the Great Recession did shrink state budgets everywhere and state budgets are the principal funding source for colleges and universities. Most of the increase is due to cost-shifting.

The recent studies of the effect of education on income and the economy tell us, though, that our de facto national policy of shrinking support for education is terrible long term. That danger is heightened by the growing anti-intellectualism on the right that sees an ever smaller need for education, science, and critical thinking.

when someone asked him “if you subsidize something that is already in demand, won’t the price go up?”

On another channel (he was all over the dial) the questioners made another point mentioned on this thread “won’t the less competitive colleges who are struggling struggle more under this plan?” His answer was to repeat his talking points.

Here’s another question people asked ” How do you plan on incenting students to major in things that will get them jobs? Does it make any sense to award a college that does an efficient job graduating people who can’t find work?” A valid question, and he ducked that as well.

A guy (Duncan) who seemed like he was fresh and new is now a mere spokesperson for some bogus policies.

in theory, but I have my doubts as to whether there’s enough financial aid to really make people not care about the cost. The fact is, that even with financial, which is now mostly loans, a private college costs a hell of a lot.

I’m sticking with the irrational buyer thesis until I see more evidence.

Worked for a major accounting firm. Graduates of certain schools (Notre Dame was one) got almost an automatic hire and their offer letter could be used in any firm office (vs getting hired locally like the rest of us).

Got insight into the hiring practices of a major consulting firm.They hired both state school and elite school MBA’s. Same general qualifications, same job responsibilities. Elite school new hires got 25% higher salaries across the board.

Know someone who has a role in hiring at a major Boston law firm. When demand for new lawyers is strong, they “dip down” to second tier schools, but when it’s weak, like now, only top 10 law school grads are even considered.

So there is some truth to the idea that you should try to get in the best school possible and pay the premium. What I don’t understand is where the whole rest of the private education system gets off charging super high rates when I don’t think it garners any benefit. I know people (and their children) that go to places I’ve never heard of. Also their is the regional aspect- we might all be aware of small NE colleges, but they are probably not known outside of the area.

In my view the problems have not been addressed. Things like for profits providing no benefit for the money, worthless majors, overspending by colleges (public and private alike), kids going to college who shouldn’t, lack of government support for state schools, and that’s just off the top of my head. People hear “go to college” in the same way they heard a few years ago “you have to own a home.” The result of a constant (psychological) demand subsidized by the government, is pretty much the same- an asset not worth what it cost.

where not going to college is too often a barrier to a good paying job. We’re a credentialist society. Education is one of the worst professions. People get doctorates through distance or low-residency learning and guess what? They rarely learn anything of value. They rarely conduct research nor do they need to. But they need the degree to get to the upper-echelons of school management. The state is even more complicit. To be a principal or vice principal, all you have to do is a program. Jobs are plentiful enough so that you can be a total clown and still get one.

It probably would have been stupid for me–a teacher–to have spent more money on my education. I really value my education, but a Harvard degree would not have made me a better teacher. (Not that I could have gotten accepted, mind you). The wisest information I ever heard about a getting a college degree was to spend only as much as you need to accomplish what you can. Instead, too many kids buy an college’s image and reputation and 4 years of a relatively care-free life.

I really, really dislike the idea of people going to school to “get a piece of paper” rather than to learn stuff, so they can contribute more, become wiser, more knowledgeable, better. I did some tutoring when I was in school, and, boy, was it painful to tutor people whose goal was not mastery but grades.

formal education. But I don’t always see what effect it has on some folks.

In fact, this price argument is based precisely on people caring very much about the price. It changes what buyers of college education regard as affordable and unaffordable.

Of course, the market for education is not filled, as you point out, with rational actors. There’s a heavy whiff of prestige. To my mind, education is very difficult to assign a value to. I could be wrong, but I don’t imagine that teaching is ever “good in general”; it is always good or bad for particular students who start off from vastly different points with utterly different goals.

I saw lots of construction going on. It’s too bad we don’t have an exchange program with other flagship universities. For example, perhaps some MA students would like to attend Univ. Of Pittsburgh and a PA student attend UMass. Why not offer in-state tuition to both? I’m sure we have kids wanting to attend USC or UNC, or Univ of Texas, offer exchange type program.

I hear you about kids and parents wanting private over public. I’m thinking of Stafford Loans and Plus Loans, some have no credit checks. Perhaps these are part of the drivers of spiking tuition costs.

I don’t know what shape it’s in. But there is something. http://ualc.umass.edu/domestic_exchange/

I think you’re talking about reciprocity. My cousin works at WNEU and her kids attend Assumption and Roger Williams for the price she would pay as Western New England. I think they go pretty much for free. Other employees don’t get such a sweet deal.

Stafford loans are subsidized loans. My niece had some loans at 12%. My daughter’s loan is at 6+%, thanks to recent actions in Congress. The thing is, if you people are getting such lousy loans they should be wanting to spend less and driving college costs down, not up.

They don’t need credit checks because they are on the hook for life. You can’t escape a student loan. You can’t go bankrupt from it. You’re screwed if you can’t pay it.

We should, as a state, get together with the other New England states, and offer a four year exchange programs, perhaps include Rutgers and a few others. I don’t see Univ. of Michigan or Ohio State participating, but who knows. Imagine if our politicians tried to turn UMass-Amherst into a Univ. of Michigan type university, then we could do equal exchanges and me and you could potentially send our kid to Michigan for $26K instead of $60K for out of state.

I guess most of our politicians come from BU or BC or Harvard or Columbia (no offense Bob) and don’t care about our flagship university.

Perhaps like our national debt, the cost of higher education is too far gone, can’t really do much about it.

Costs, quality, competition are all components of the higher education challenge. Mark-bail stated accurately that escalating costs and reduction in government/taxpayer funding or subsidies (which is not intended as a blanket pejorative word.)

Another way to see this statistic is that almost half of the state funding per pupil has been lost, while the costs and inflation have driven operational expenses higher. The delta/gap in the government/state funding is a culprit leading to the unaffordable costs for the middle class.

I would like to note that the same problem is responsible for gaps in public education services preK-12.

While it appears that per pupil costs have increased – the actual dollar figure in most communities has increased. The “buying power” offset by drops in % of district state funding, compounded by inflation of costs are critical causal factors in rising costs and reduction of services. Again, the middle class public school student, teacher and district take the hit.

I honestly think most colleges can switch to a two year format and give people tons of technical skills to get employed in the workforce. We could raise the prestige and value of Associates Degrees and Technical Certificates. If I want to be an IT guy, why do I need to take a ton of certifications while also getting a BA in Philosophy or Poli Sci? I also think our high school education system is designed around a college prep track that may not really prepare most students for the real world of work. If we could use high schools to make plumbers, technicians, engineers, IT guys, electricians, carpenters, etc. we could also solve a lot of these problems.

The Germans have a three tier system. Two years for artisan, three years for business/management, and four-five years for a liberal education which usually results in a MA. Law and Business degrees can also be obtained after just five years of school. I think if we eliminated MBA and JD and merged them into undergrad tracks, creates stronger vocational tracks and two and three year programs, we could really curb costs. We also have to educate high school students about the reality of what their degree is worth, the jobs they can get, and get them to be realistic about their options. Too many middle to upper middle class families took on a ton of debt to fund their kids education at over priced middle brow institutions like GWU, NYU, Trinity College, etc. when they really would’ve gotten an equivalent education at a state school.

This article is telling about a lot that is wrong with higher ed.

I valued the liberal education I got at U of C, and feel like I got a much better education than peers at similar institutions like the Ivy’s or near Ivy’s. I had direct access to my professors, small classes, we read the actual source materials rather than synopses, we had socratic seminars, and we are now well versed in the great books and philosophers, but I would totally have buyers remorse if I didn’t get a huge financial aid and scholarship package. My future sister in law has a much better career office at Eastern Illinois University, supportive staff and teachers, and a direct focus from day one on employment and keeping costs down. Northeasterns’ grad programs are looking awfully tempting to me and my fiancee, partly because I want to come home and partly because of the cooperative program seems like a surer bet to employment than another aloof elite institution with a higher debt load.

We should eliminate college athletics. Its a total joke.

It can bring in money to the university and it keeps the students busy, it’s like having a job, if you are a collegiate athlete, better than hanging out at the dorms or frat houses. Tax it, absolutely. I agree with much what you said in the prior comment.

If you are in Illinois, you and fiance should look at moving to Wisconsin, better job prospects, better governor, pro-business.

Turning one’s state, as Charlie Pierce has often put it, into a wholly-owned subsidiary of the Koch Brothers does not auger well for widely spread prosperity.

It’s also simply not true that Wisconsin has a better business climate than Illinois.

The usual suspects – the National Taxpayer Foundation – ranks Illinois (#29) well above Wisconsin (#43) in their oft-cited measure of the “state business tax climate”: http://taxfoundation.org/article/2013-state-business-tax-climate-index-results Massachusetts, by the way, is above them both at #22.

AND Forbes magazine’s rankings (which take in to account Quality of Life and Labor Supply issues) rank Wisconsin as a dismal #42 in their “Best States for Business” while Illinois is #38 and Massachusetts is at #17. http://www.forbes.com/best-states-for-business/list/

WI unemployment rate is 6.8% VS Illinois at 9.2%. Wisconsin got a grip on legacy costs with reforms in collective bargaining, Illinois had the worse funded pension system, a/k/a ticking time bomb.