Gabrielle Gurley reports in the ever-excellent Commonwealth Magazine’s Daily Download newsletter that the state is about to pile on more debt to finance MBTA projects:

Massachusetts is about to hit its debt ceiling, which will set off a whole new round of under-the-radar maneuvering on Beacon Hill.

Debt financing is a topic that is inscrutable to the average taxpayer. But all sorts of projects that send Bay Staters’ hearts aflutter are made possible by generating tons of state debt.

Like rail for starters. Five of the six projects that are pushing the Bay State up to its debt limit are MBTA projects: new Orange and Red Line cars; the long-delayed South Coast Rail line to Fall River and New Bedford; Fairmount Line improvements; South Station expansion plans; and the notorious Green Line Extension.The lone non-MBTA project is the Pioneer Valley Knowledge Corridor improvements linking Springfield and western Massachusetts towns to Vermont.

Massive additional spending on infrastructure is crucial to the Commonwealth’s economic future: the T drives Boston’s economy, the Commuter Rail system supports residential real estate values in the entire Greater Boston area, and rail systems link us to opportunities across the Northeast. Our future depends on effective mass transportation.

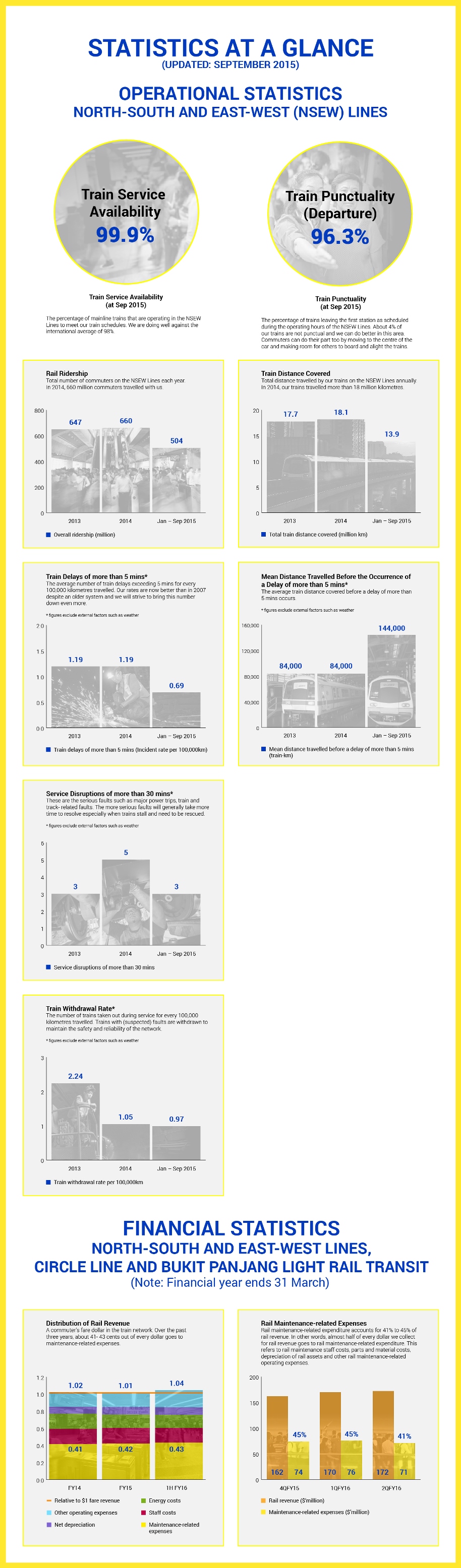

But the existing structure of a publicly owned system is obviously deficient. We’ve gone from being among the best in the world 100 years ago to being badly second-rate compared to Singapore, Hong Kong, Tokyo, Paris or many other large cities. Just take a look at the websites for those systems and the differences in relative performance are quickly apparent.

Worse, the rate of our relative underperformance is accelerating, from last winter’s disasters to the recent runaway Red Line train and the infamous “open doors” ride, to the multi-billion dollar botched Green Line extension. It’s not a people problem. Massachusetts residents, as we all know, are gifted and superlative. It’s the system: the Authority structure cannot generate the capital it needs — it can’t even cover operating expenses — and has proven itself a deficient long-term manager.

There is a better way: quasi-privatize the system, as is done in Hong Kong and elsewhere. The Commonwealth will still own a majority stake, as it should for such an important community resource, but a minority interest can be listed on the stock exchange to generate some of the billions in capital finance the system obviously needs, and market-driven management changes can be implemented to improve operational effectiveness. I’ve said this before, and we’ve had excellent and informative discussions on the subject, and I apologize to anyone who finds the subject wearisome, but I think it bears repeating because as time passes the inadequacy of the Authority structure becomes ever-more apparent — barely able to operate safely, unable to significantly improve, and deeper in debt — and the performance of this alternative is so obviously better. We don’t have to live like this.

Take a look at Singapore, which has a population a bit smaller than the Commonwealth’s and roughly equivalent income levels:

We’ve sparred over this in the past, and I won’t re-litigate that argument. A more interesting question is: how would you implement this in Massachusetts and what would it look like?

It’s easy to say, some other country or even some other state does ‘x’ and we should do it. I am guilty of that as well, and actually, copying best practices is a key component of real policy making, so it shouldn’t be scoffed at. That said, you know the climate we have in the Boston area is one that is still riddled with the Big Dig culture that produced public private partnerships that largely enriched the private sector while fleecing the public sector.

This American innovation is not unique to Boston, Chicago’s CTA has tried it with a disastrous rollout of a private fare card collection system that is woefully less adequete than the far easier to use in house model they initially had. I’ve linked to that in our past discussions. Or the Morgan Stanley deal for parking meters. Or the lousy planning of Boston 2024.

So in theory, this could be a great victory for cooperative economics. If we just make the MBTA a publicly traded company, raise investments for it, and begin leveraging the real estate abutting it, we can fund the $7 billion it desperately needs without having to raise taxes and also implement transformative mixed use hub and spoke models of transit and smart development. In theory.

In practice, I am not sure how that looks in the US. China and Singapore are much harsh on public corruption than we are, imagine if DeLeo feared losing his freedom or his life, would he still think fight for measly patronage jobs? Singapore also has internationally low levels of corporate corruption and a highly ethical form of government (partly because it pays it’s government officials private sector equivalent salaries). Those systems are also undemocratic and lacking in other aspects of oversight we might value.

Is there a closer apples to apples comparison you can rely on? It seems that this plan ended up making the UKs transit system significantly worse, has Canada or another democratic peer followed this lead?

The public rail systems in Hong Kong and Singapore are among the best in the world and similarly structured, which is why I suggested them as the best model. Those are both capitalist economies with many similarities to our system and far better outcomes: I think they stand as good models even in the absence of direct domestic parallels. I agree that the Big Dig culture and the legislature’s corruption is an important contributing factor to the MBTA’s failures: all the more reason to run it more like successful local businesses listed on the stock exchange, many of which are extremely well managed and quite successful. That said, Comsat was a federally chartered private listed company something similar to what I suggest. This 2011 CRS report discusses the subject quite comprehensively. I’m not an expert in administrative law, but I know a failure with no realistic prospect for improvement under the status quo, and extremely successful alternatives when I see them.

Then failed as businesses because of the poor fundamental economics of mass transit railroads. That is the genius of the Hong Kong and Singapore solutions: they combine real estate development, which can be extremely profitable, with rail development, which boosts the property values, in a privately managed business controlled by the state. That is how they generate the billions of dollars of continuing investment the systems need — the lack of which is crippling our system and starting to degrade the broader economy as well.

Or any other state legislature, for that matter.

I’m all for the MBTA getting significantly more oomph out of its land, but it doesn’t need to become “a privately managed business controlled by the state” to do that. It can just do that.

As jconway observes, we’ve already gone through this argument.

I think we’re in violent agreement that the current funding approach is dreadfully broken.

While privatizing is one option, there are others.

Picking Singapore and saying “we should do the same” is like showing how a Lottery winner was able to rescue himself or herself from crushing debt using the Lottery winnings and concluding that playing the Lottery is a good strategy for debt management. It is not.

Massachusetts needs to significantly raise taxes on the wealthy, and needs to invest the resulting new tax revenue in solving the debt crisis of the MBTA.

That’s far less complicated, and straightforward if our government can find the political courage to speak the truth. I suggest that without that courage, neither privatization nor any other approach will succeed.

We MUST raise taxes on the wealthy. The claim that tax increases are not urgently required today is a flat-out lie.

Fundamentally, I think the withdrawal of the top of the population from the tax system is a key element of the current American decline. That the majority of the population permits this is an indictment of their judgment and an illustration of the contemporary limits on our democratic form of government. That said, see my response to JC above: the ideas are not mutually exclusive.

–Singapore has taxed cars to the point that they are no longer middle class goods. A new Toyota Prius costs the equivalent of $154,000 and requires almost 10-15 years of middle class worker savings to achieve, and then they charge taxes for adding garages to homes. They have very few public parking spaces and also charge congestion pricing. Private car ownership is at about 15% because of this.

-It is more densely populated. It’s an island the size of three District of Columbia’s that is almost entirely developed surrounded by well preserved rainforests. We are already talking about a very low carbon footprint environment with a strong tradition of support for mass transit

-It is a full ten points higher on the corruption index than the US

I suspect Hong Kong is similar when it comes to these three factors.

I am not against the proposal ideologically, I am just not convinced it is workable in Massachusetts without making substantial changes to how we view cars, land, transit, and how we do business. Arguably changes we have to start making anyway, since there are other ways we may resemble Singapore pretty soon.

But a both/and approach may be needed. A good start would be adopting Germanic pricing models for contracts, so we aren’t perpetually fucked over when people we pay hundreds of millions of dollars fail to deliver. In Germany if there are cost overruns the contracted entity assumes them, not the public entity, since the company was responsible for failure to deliver on time and on budget.

This small change would make a radical difference in how quickly and cost effectively our projects could be built here. Of course, like any best practice, there are probably other reasons it can’t work here. But I am open to finding ways to can, since can’t is no longer an option for transit.

I agree that the two approaches aren’t mutually exclusive.

We’ve already seen how “privatization” works here in Massachusetts, given our current legislative “leadership”. The Boston24 and casino fiascos persuade me that any effort to privatize public transportation here will do little more than kick off another round of graft, corruption, and cronyism.

The political courage and integrity needed to make privatization work is better directed towards raising taxes on the wealthy. While the two aren’t exclusive, I suggest that the kind of privatization you propose isn’t possible without political courage and leadership, and isn’t necessary with it.

People who aren’t desperate don’t view playing the Lottery as a viable financial strategy. Similarly, if we weren’t desperate for reasonable governance, we wouldn’t view privatizing the MBTA as a viable transportation strategy.

…that such infrastructure investments should be entirely public AND I would like to see rates actually go down to encourage more ridership.

Does anyone even know a person who uses public transportation … yoinks!

I use it occasionally and they seem reasonably clean, and the carriers are often packed so I think it’s fair to say it gets some use. I’m guessing you don’t live inside 128.

The fact that they are even thinking about raising rates but won’t even dare put alcohol ads on the T, sell naming rights, or sell air rights shows how out of touch they are with how funding transit works. Raising rates will contribute to the T’s death spiral, something moderate ad revenue will at least help delay.

They are visual clutter and helping foot a bill which should be borne by the people.

What’s the marginal difference in annual ad revenue due to not allowing alcohol ads? And what percentage of MBTA revenue is from ads? Methinks that is a remarkably small number. Same goes for naming rights. A one time cash infusion to sell out? Meh.

Air rights? Now we’re talking. This is where the MBTA meets Bob’s Singapore plan. The air rights are valuable, in part, because of the T. I’m all for developing them.

The alcohol ads, again, a non grata idea in Puritanical Massahusetts, would generate about $2 million. Alcohol sales at terminals generate about $10-15 million in annual concessions for Chicago’s commuter rail, and are also a selling point in increasing ridership. Raising fares would generate $23 million. Both proposals are a drop in the bucket for the $7 billion the T needs to be fully updated, modernized and solvent.

But the fact that basic ideas like alcohol ads and sales aren’t even on the table but apocalyptic ones like raising fares are, shows how tone deaf these guys are as to how transit works. The air rights could be huge and would do much to alleviate the housing crunch if developed properly. We have the rail yard behind the South End, the commuter line space between Porter Sq and Somerville Ave, and the leg of the red line between Southie and Quincy, not to mention the GLX corridor. That’s just within metro Boston and off the top of my head. I’d consider those three ideas and more before is even touch the fares.

Alcohol ads are a no-go.

You wouldn’t put them on the sides of a yellow bus. We give students discount rates on the T during school hours precisely because we know kids take the T to school.

Alcohol sales? You bet. Obviously, you take steps to ensure (a) no minors are drinking, and (b) the customers aren’t going to turn an evening drink on the way home into an frat party from Animal House. If the T can pull off (a) and (b), by all means sell some adult beverages.

Air rights? Youbetcha. Don’t preclude a good transit-centric improvement 20 years from now for some short capital infusion today, but by all means pick up the development money, and parlay it directly into capital projects, preferably those that reduce forward going operating costs.

Nearly every child is going to watch a sporting event on television during their childhood and see an alcohol ad. Even kids that don’t watch sports will see the Clydesdales this season on most networks and most will watch the super bowl which will have them almost wall to wall. It’s just as unhealthy as all the soda and fast food products we regularly allow them to see, and it doesn’t influence buying habits as I’ve never bought a Bud Light in my entire adult life.

Alcohol is one area where Massachusetts progressives are blind to best practices states have had decades ago from BYOB to alcohol sales on trains to happy hour to late night trains to allowing grocery stores and drug stores to sell liquor. Chicago has all of those things and our teen drinking rates, drunk driving rates, etc. are at the national average alongside Massachusetts. These changes will make our city and region more livable, entice youth to stay here for careers after graduation, and raise revenue without raising taxes which our legislature seems loathe to do.

to work at the T itself.

The annual cost to the MBTA of contracting for commuter rail services has risen by 99.4 percent since 2000, compared with a 74.9 percent increase in the annual cost of the agency’s in-house bus operations, according to cost information we compiled from public online sources.’

There is a sort of automatic assumption that the private sector will solve all the problems at the T and elsewhere. But experience has shown that isn’t the case.

I appreciate he acknowledges that what he is proposing is a somewhat different idea than American or British privatization. In the states it means giving a connected company a public asset and letting them run it to the ground Bain style or overcharge Bechtel style. In the case of Chicago’s fare cards and parking meters it’s a little bit of both. Across the pond it has far less corruption, but is still contracting the management of an existing asset to an outside firm.

Bob’s model is making the T a publicly traded entity that anyone could buy shares in and using that revenue and the real estate to make it solvable and sustainable. Now, the fact that publicly traded passenger rail companies failed bad has to be consolidated into Amtrak is the better argument, but he would counter than the air rights and real estate weren’t utilized properly.

I still say a progressive tax, better oversight for contracts, and either the carbon tax or a gas tax could help solve the issue. You’d still have to get federal money or a bond order to pay for some of it. But his idea is genuinely interesting, I wonder if a better method would just be having the MTR buy out the T. It already operates Australian, British and German lines. In this season of nativism you’d have a Dubai ports issue, but it may make more sense relying on the one group that’s done it right rather than trying to reinvent their wheel on our own in Stanley Fish’s backyard.

different than privatized transportation and infrastructure systems in this country. There certainly are a range of privatization models in this country to choose from — from contracting operations as is the case with the MBTA to the outright transfer in 2005 of a system to a private consortium, such as the transfer of the Chicago Skyway and the neighboring Indiana tollway to a private Spanish-Australian consortium.

Ten years later, after some major toll increases, the Indiana tollway filed for bankruptcy and the consortium put the Chicago Skyway up for sale.

No doubt there are success stories in privatization deals, but is it always a better way? Not necessarily. These deals need to be approached with caution.

advantages was Hong Kong government also made rail transportation a priority, which is something we haven’t done. 90% of the daily journeys are on public transport, making it the highest rate in the world (Wikipedia). Hong Kong also went through a change in government in 1997, which may have made a political difference. China has different rules\laws for privatization as well.

Massachusetts policy has been more like, “Wouldn’t it be nice if…” but we cut taxes by $3 billion a year, and we need to live between our means, so…

Right now, we need to invest in our transit system and raise the $7 billion to do so. Most of this can come from implementing progressive taxation, and raising other taxes in a fair way to generate the revenue the T needs to survive. Then, I would implement a contracting process that has safeguards in place to ensure changes are on time and on budget. Find more partnerships like New Balance, maybe even in exchange for naming rights and other benefits just to get the ball rolling on new stations, new stops, and new constituencies with increased ridership. And prioritize the damn thing, which the legislature hasn’t done in decades.

Once we get a healthier T, than I think we will be in a better place to assess how to manage it better.

What Bob is proposing is different than the Chicago and Boston privatization we’ve seen, it’s not transferring management of a public asset to a single private entity but turning a public asset into a self sustaining private entity by making it a public company. There are still risks and tradeoffs involved, but it’s something entirely different than anything we’ve done in the past. I would agree that those systems were in far better shape before the rang the bell on their exchanges.

Chicago Skyway and the Hong Kong or Singapore privatization arrangements. As I understand it, the private consortium essentially bought the Chicago Skyway from the city by paying over $1 billion for it in exchange for the right to operate it for 99 years. The plan was for the asset to be self-sustaining in that the consortium would derive its revenues from tolls collected from drivers.

This seems similar to the Hong Kong system at least to the extent that a private company, MTR, runs it as a self-sustaining entity. I understand that MTR was transformed from a public agency to a shareholder-owned company.

I’m not quite clear whether MTR is now totally private or is still partially owned by the Hong Kong government. But, in any event, I’m not sure that whether an existing company or consortium buys a public asset or the public asset is simply auctioned off to investors on the stock market makes all that much difference.

for example, a new, small tax on any business within X miles of a subway, rail or bus stop, in a way that reflects the value of that subway, rail or bus stop to the business — both in attracting costumers and making it possible for their employees to come to and fro.

Lots of other countries do exactly that. A modest tax in this vein could reap a lot of revenue for the MBTA. In allowing that tax, direct the revenue toward paying off the highest interest loans or closest-to-being-paid-of first, so the T can get some of those bonds off its books, so it isn’t so cash-strapped.

Privatization wouldn’t be implemented the way Bob would like, not with the Republican in charge. The American ‘brand’ of that just means killing unions, cutting service and stripping away middle class jobs. We don’t need more of that in MA, there’s been plenty of it as it is. We just need to get the MBTA the revenue it needs, first to dig itself out of its hole (which, unfortunately, will take some time) and then to set course for bringing the MBTA into the 21st Century.