In the wake of that boffo MassInc poll, the legislature is actually hearing the overwhelming vox populi on transportation: We need to invest more money! This puts them at odds with Governor Baker’s No New Taxes grumbling.

House Speaker Robert DeLeo [!!! — ed] and Senate President Karen Spilka are both open to raising additional revenues for transportation and the two chairs of the Legislature’s Transportation Committee, in an interview on the CommonWealth Codcast, said new money is desperately needed.

…

“I think money is the answer,” said [Sen. Joseph] Boncore, who called the 3 cent increase in the gas tax approved in 2013 insufficient. The Legislature in 2013 also indexed the gas tax, allowing it to rise with inflation, but that part of the law was repealed as part of a referendum campaign backed by Baker.

Boncore said the state needed to be bolder in 2013. “We’re seeing a system now that’s failing because of a lack of investment back then. So I think it’s crucial and incumbent on us to make the investment now,” he said.

In spite of his enduring popularity, Baker represents very old-fashioned, very Republican habits:

- Insist on No New Taxes, regardless of the situation, deficit, or need;

- Spend down surpluses that liberal Democrats raised;

- Borrow-and-spend stat tax-and-spend;

- Ignore the long-term; let some future liberal Democrat clean up after you. It’s the tomorrow-we-die attitude cited by Michael Lewis in The Big Short: IBGYBG (I’ll Be Gone/You’ll Be Gone). (See below.)

Seen this movie before? Baker’s aversion to new revenues is driven by political calculation, not a disinterested, apolitical accounting. And it is incompatible with long-term stewardship of our transportation system.

Baker keeps pointing to the $8 billion that the state is poised to spend on MBTA improvements — without raising taxes. This is indeed good and welcome news. So where does this money come from? Not growing on trees. The windfall comes from:

- Governor Patrick’s 2013 gas tax increase;

- borrowing (bonds);

- the federal government;

- and, to be fair, cost control on the operating side.

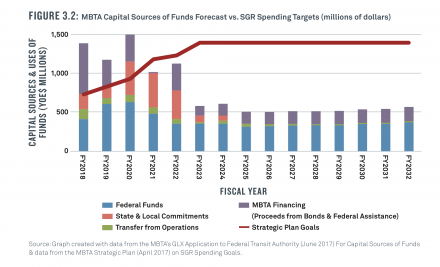

I’m making my way through the very useful report from A Better City, which refers back to the Transportation Finance Commission report of 2009, and assesses our progress in its various goals. This chart and commentary are illuminating (pg. 31):

MBTA Capital Sources of Funds Forecast vs. SGR Spending Targets (millions of dollars)

It is noteworthy how this MBTA plan is funded. Only 27% of this $8 billion is supported by new MBTA debt. Most of the spending over the next five years is funded through the federal government, one-time borrowing programs financed by state transportation dollars, and annual transfers of aid from the state budget. Utilizing other sources of funds allows the MBTA to address key projects without significantly increasing their long-term debt burde

The favorable conditions for the MBTA’s FY19-23 capital plan appear to be unique and temporary. GLX is funded through federal funding and the Rail Enhancement Bonds program, which is a special borrowing program supported by Massachusetts’ gas tax and RMV revenue. The purchase of new vehicles for the Red and Orange Lines is also largely supported by the Rail Enhancement Bond program. While the MBTA does contribute to these key projects, it is only a small portion of the project costs.

After 2023, when these three important projects are completed and the one-time sources of funding are spent, the MBTA will still face ten more years of increased capital spending to address their $7+ billion SGR [State of Good Repair] backlog. After 2023, if the MBTA is forced to increase their own borrowing to fund SGR spending goals, the impact of higher debt service costs will increasingly squeeze the MBTA operating budget.

The bill comes due eventually. We’re living that now.

Something else from Rep. Straus’s comments deserves considerable attention as well:

The governor has said additional revenue isn’t needed for the MBTA because the transit authority will have a hard time spending the $8 billion in capital funds he has set aside. Straus doesn’t buy that argument. “If that’s a way of saying I need more staff resources, tell us that,” the representative said.

The lack of experienced, professional contracting oversight at all levels of government is a massive problem. For example, California’s high-speed rail was plagued by outsourcing of management to consultants, to the tune of $44 billion over budget and 13 years late:

Despite repeated warnings since 2010 about weaknesses in its staffing, the rail authority believed it could reduce overall costs by relying on consultants and avoiding a large permanent workforce. [emphasis ed]

(Hear Straus’s extended riff in this excellent podcast, starting at 26:27.)

At first blush, that “large, permanent workforce” seem expensive at the state level. But it’s penny-wise and pound-foolish not to have strong contracting and public works leadership in-house, in the government. These are perhaps the most fiscally high-leverage positions in the whole state. It’s worth it to hire good staff. As baseball executive Bill Veeck said, “It isn’t the high price of stars that is expensive, it’s the high price of mediocrity.” Paying good money to the Mookie Betts of project management is well-spent; paying anything to Pablo Sandoval in a hard hat is unwise.

Late last week I talked with Josh Ostroff of the influential Transportation for Massachusetts, and he had this comment via email:

Transportation need not be a source of pain and frustration that threatens to drive people away while it harms our climate. It can, and should be a pathway to opportunity and connections. We can’t use the status quo as a benchmark. We must aim higher, and we should be acting with a sense of urgency over the congestion and dysfunction that is a daily struggle for commuters. All over Massachusetts, people urgently need better, more reliable, safe and clean transportation.

Over the coming two months, we will be looking closely at the five year capital plan for MassDOT and the MBTA to understand what short- and long-term investments are funded, and what we need but can’t fund within current revenue. We expect that process will inform the debate over the mix of revenue, including broad based taxes, user fees and revenue options at the local level as are common all across the country.

To its credit, the Administration has made progress with reform and cost control on the operating side. But we can’t reform our way into billions of dollars of new public investment. And we need to be prepared to ramp up our operating budget to make sure we have great project management to shepherd and safeguard these new investments.

This is couched in a friendlier way than I’ve put it above. But you can see that most of us are on the same page. The governor is out of step, playing a 1980s tune; and the question is whether we move on with or without his help on new revenues.

See that ~100M green sliver in FY18? Every time the bus passes you by because it’s full, think of that green sliver. Every time the commuter rail cancels a train, think of that green sliver. When the T is running weekend/holiday schedules on big event days in Boston and the station platforms are jammed, think of those green wedges.

We don’t have enough operating budget for the MBTA. We’re not running enough buses, enough subway cars, enough buses. We’re probably not staffing enough preventative maintenance either. Our quality of service is down, because in addition to other things, there aren’t enough MBTA employees working during busy times. That’s an operating budget deficit, and hey lookie — the green sliver is money taken away from operating to spend on capital. That money should come from taxes instead (as should additional money for operating budget!).