Sunday and Monday's Boston Globe highlight an estimated $25 million a year the state gives in questionable tax breaks to businesses aimed at economic development.

Sunday and Monday's Boston Globe highlight an estimated $25 million a year the state gives in questionable tax breaks to businesses aimed at economic development.

The Massachusetts Economic Development Incentive Program is part of $1.7 billion in tax breaks the state gives out every year that are aimed at economic development (for more on these breaks, check out the Mass. Budget & Policy Center brief).

While Legislative leadership has been reluctant to raise revenues, it's hard to fathom how our cities and towns will absorb the cuts that will come from an expected 5 percent reduction in Local Aid.

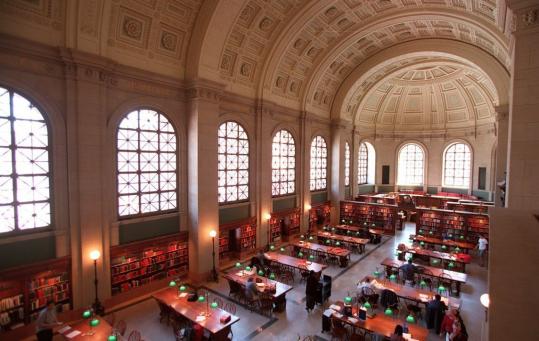

In communities across the state libraries are closing or scaling back their hours, police and fire fighters are facing lay offs, and the essential city services that keep communities functioning are imperiled. Legislators have been working to make the businesses that receive tax credits from the state more accountable.

Last year, the Revenue Committee passed a bill that would have required businesses receiving tax credits to issue annual reports detailing the job creation they commit to when applying for the tax credits.

While the bill did not pass this year, there is growing awareness of the numerous loopholes in the state's tax code. Now more than ever, our elected officials must weigh these tax expenditures against the cuts they're making in our communities.

(Cross-posted on ONE Massachusetts)

The short sightedness and lack of any coherent plan in the cuts made, many of which seem to me to cost more than what is saved, leads me to say “NO MORE CUTS” and “I think I could do better.” I think Judy or Yawu could plan and choose more effectively, for that matter.

Amber, I definitely understand what you are saying. But the bottom line is that without cuts, revenues will need to increase dollar for dollar.

<

p>This budget is supposed to eliminate $797 from the state government. If that is not palatable to you, what would be your suggestion? Income tax increase? Toll increase? Sales tax increase? Reduction in spending on something else?

<

p>Are you arguing that the cuts are being done broad-based, like “10% from everyone”? I agree, such a plan is not very effective. But I don’t know if that’s happening.

<

p>From what I hear, the education cuts are being made somewhat intelligently, whereas cuts will be avoided if they bring spending below foundation levels. That’s probably a reasonable and progressive way to spread them around, though residents of wealthy districts will complain that they are being hit harder than residents of poor districts. Of course, they can generally afford it better.

I agree with the no cuts sentiment. If I were the Speaker, I would go with an income tax increase and start the process of getting a constitutional amendment allowing a progressive income tax. I’d also raise estate taxes.

<

p>Sales tax increases as a last resort, starting with imposing candy and soda taxes.

<

p>Plus cut the Leg’s slush fund, the courts’ budget for law clerks and other stupid stuff, similar cuts from constitutional officers, sheriffs, etc. Cut any money DAs are using on enforcement of laws against victimless crimes.

<

p>Cut any tax credits that don’t demonstrably create jobs, unless they have a worthy non-economic benefit like promoting renewable energy. I haven’t gone through and looked at all of our tax credits, but it’s quite possible that this one by itself would bring us up to the magic $797 million we need to save.

<

p>Throw in some consolidation of redundant agencies here and there, and you’ve got yourself a budget. And consolidation of redundant school districts. This is something that really could be done at the county level for the same quality and less price.

<

p>If I were Governor, I’d do all the above plus offer an automatic pardon to anyone convicted of a victimless crime and close the prisons/jails that became redundant as a result.

<

p>And if we had a magic wand that, with one wave, could mandate a balanced solution to our 3 billion+- budget gap, we would include some significant new revenues, judicious use of the rainy day fund, and another round of federal stimuls money, may we could figure out some “more effective” consolidations and cuts.

<

p>Of course we don’t have the magic wand and in our representative government we have to deal with a messy democratic process that demands that an elected Governor propose a solution to two different branches of an elected Legislature that has the power to develop their own solutions. And it’s in the Legislature’s hands now. They know the choices they face. More taxes or more cuts and they say they see no public support for more taxes, so it’s more cuts to be announced on April 14.

<

p>If you havn’t seen it yet, here is an excellent analysis of the Governor’s proposed solution from [Mass Budget and Policy Centerhttp://www.massbudget.org/documentsearch/findDocument?doc_id=645}.

<

p>

When it is laid out like this, it is a very good case. The sacrifice is being shared. Although no one could love a budget like this, it is worthy of at least respect for trying.

<

p>Unfortunately, most people do not want to even try and understand the budget. They just like to yell and complain. Sadly, they often vote for people who yell and complain just like they do.

<

p>I think we owe it to the governor to, when people complain about cuts or taxes, to make them tell us what they would do instead. For example, if you don’t like the candy/soda tax, then tell us what you would get rid of to save the $61.6 million that will be lost by eliminating it.

<

p>And if you got an idea of where to find 100 million or so starting July 1,2010, tell it to the House and Senate. They have announced they don’t want to remove the exemption from the sales tax for candy and soda, they don’t want to count on unconfirmed federal dollars, are quesy about suspending the film tax credit, and finally they want to restore some of the cuts in human services.

<

p>And so they will be cutting local aid and chapter 70. All of this in broad transparent daylight.

the sacrifice is being shared?

<

p>The corporate tax cuts and tax cuts to financial institutions that went into effect in January are clearly tax cuts we cannot afford if we are discussing ways to make up that revenue. It also flies in the face of the concept of shared sacrifice. Why not start with taking back those tax cuts? That would more than cover that $61.6 mil.

http://www.massbudget.org/documentsearch/findDocument?doc_id=694

<

p>Those who have lost their jobs have already been sacrificed. Is it fair to ask them to sacrifice again with regressive sales tax increases, (candy/soda), before requesting some give from those who are still making 6 figure profits? There is a case for an increase in a progressive income tax hike.

<

p>What about eliminating the wasted with those investment credits that the Globe highlighted last weekend.

<

p>Maybe get creative. Home foreclosures in Massachusetts rose this February over last February. How about a tax on foreclosed homes? How about a 90% tax on credit card revenue on interest above 10%.

<

p>Let’s really share the burden.

Who are the players concerned with the state budget?

<

p>* Taxpayers

<

p>* State employees

<

p>* Service recipients

<

p>* Businesses

<

p>* Cities/towns

<

p>Maybe there are others, I’m not sure. I suppose you could break things down into “wealthy” and “poor”.

<

p>I said that the sacrifices are shared because people from all those groups are being directly affected. Taxpayers are paying somewhat higher taxes. State employees are getting somewhat less raises and benefits. Service recipients are getting somewhat less services. Businesses are paying slightly higher taxes. Cities and towns are getting somewhat less state aid.

<

p>We can argue about whether the sacrifices are being shared in the correct proportion, but I think that everyone is being directly affected.

<

p>The last time we had a fiscal crisis — 2003 — not all parties chipped in. We did not raises taxes in 2003 (just fees). We did not close corporate tax loopholes. We did cut state aid to cities and towns. We did cut services. I’m not sure if we gave state employees less raises and benefits, I don’t think we did though.

<

p>The corporate tax cuts you referenced were part of a corporate tax restructuring. My impression — which could be wrong — is that overall, this was an increase in the overall taxable amount that corporations would pay, though the rate might now be lower. Please correct me if I’m wrong on that. The article you referenced seems like there was a loophole that was left open, and it makes sense to explore closing it, particularly if it benefits just 128 companies. I don’t know the rationale for this deduction, and the article didn’t explain it well.

<

p>I’m not seriously concerned about candy/soda taxes being regressive, since those food items are fairly discretionary, and there’s not much rationale for exempting them from the sales tax.

<

p>I do think that the tax credit stuff should also be explored. It sounds like a shell game to me. Springfield just exempted 12 years of property taxes to the Titeflex corporation to save 100 jobs, 33 of which are in Springfield. The break is supposed to cost the city $300,000 — so that 67 non-residents can keep their jobs. It would make sense if the state picked up part of that because 2/3 of the direct benefit goes outside the city. Was that worth it? I have no idea? It would have been politically and psychologically bad for the city if the company moved, as threatened. Would they have moved for $300,000? Seems a little doubtful, not quite sure. Was it a winning proposition? Again, no way of knowing.

<

p>Yes, there are other things which could have been done. They should all be explored. That’s what government is supposed to do. But overall, although I’m not happy about reductions, I’m happier than if the deficit was closed on just a few of the players.

Here’s an idea that I’m sure would be controversial.

<

p>The Community Preservation Act allows for an increase in the property tax that has been approved by a city or town. The state then kicks in a matching amount to increase the city or town’s pot.

<

p>The money must be spent on a combination of open-space acquisition, historical preservation, and/or affordable housing. A minimum of 10% must be spent on each category.

<

p>Look at the list of communities that have adopted the CPA. Lincoln. Wellesley. Longmeadow. Wilbraham. Lexington.

<

p>Look at the list of communities that have not adopted the CPA. Lawrence. North Adams. Springfield. Holyoke. New Bedford.

<

p>What is the reason? Because poor communities are not going to vote to tax themselves higher, and wealthy communities will.

<

p>So the matching funds represent the state giving rich communities money for being willing and able to charge themselves more in taxes. That’s a little like giving a tax credit to the homeowners that install marble fountains on their lawn. Or, to be precise, giving matching state aid to communities that override Proposition 2.5. If you like basketball metaphors, that would be like giving the top pick in the NBA draft to the team that wins the championship.

<

p>It’s not a huge amount of money, but it was $31 million last year. The money is generated from “primarily from surcharges on fees charged for recording various documents with the Registry of Deeds or Land Court.” They are a flat fee, apparently $10-$20 per transaction.

<

p>That means larger, often poorer cities are providing the bulk of the money to fund projects in wealthier communities. If a million dollar home sells in Lincoln, the owner pays $20 (which eventually comes back to Dover), and if a $50,000 home sells in Springfield, the owner pays $20 (which goes to Dover).

<

p>There have been rumblings (bill filed by Sen. Cynthia Stone Creem of Newton) that the fee should be increased, perhaps to $75 from their current $10 to 20, so that the state matching amount can be guaranteed to be 75%.

<

p>Don’t get me wrong — I think the idea of preserving communities in those ways is important. But when you look hard at this program, it is a naked transfer from the poor to the wealthy using a regressive fee. I think that when times are tough and things are being cut, this is something which can afford to be eliminated, and I think that when times get better, the fee to fund this should either come from the income tax, or from a deed-based fee that is tied to the value of the property, and not a flat fee.