Moving across country and buying a new home are stressful events. Those stresses were partially eased for my wife and me because we were moving back to Massachusetts, a state that recognizes our same-sex marriage and protects residents against discrimination based on sexual orientation. Imagine how our stress levels soared when we were discriminated against as a married same-sex couple by Wells Fargo Home Mortgage (WFHM), our mortgage provider in Massachusetts.

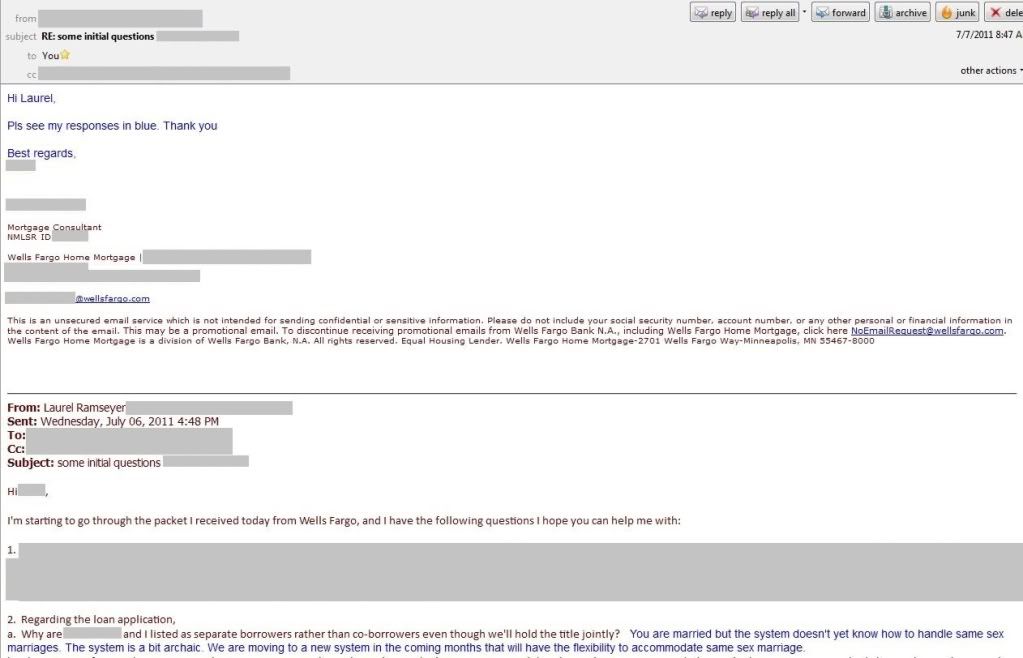

From the start, WFHM insisted on treating my wife and me as separate borrowers rather than co-borrowers. This is not something they normally do with married couples. When asked for an explanation, our mortgage consultant wasn’t shy about the reason for the discrimination: we are a married same-sex couple. Here are the pertinent parts of our email exchange (right-click the picture to enlarge):

From: [Wells Fargo Home Mortgage Consultant]

Sent: Thursday, July 07, 2011 8:47 AM

To: Laurel Ramseyer

Cc: [redacted]

Subject: RE: some initial questionsHi Laurel,

Pls see my responses in blue. Thank you

Best regards,

[redacted]

Mortgage Consultant

From: Laurel Ramseyer

Sent: Wednesday, July 06, 2011 4:48 PM

To: [Wells Fargo Home Mortgage Consultant]

Cc: [redacted]

Subject: some initial questionsHi [Wells Fargo Home Mortgage Consultant],

I’m starting to go through the packet I received today from Wells Fargo, and I have the following questions I hope you can help me with: [snip]

2. Regarding the loan application,

a. Why are [my wife] and I listed as separate borrowers rather than co-borrowers even though we’ll hold the title jointly? You are married but the system doesn’t yet know how to handle same sex marriages. The system is a bit archaic. We are moving to a new system in the coming months that will have the flexibility to accommodate same sex marriage.Thanks,

Laurel Ramseyer

“Sexual orientation” was added to the Massachusetts law banning discrimination in mortgages way back in 1989, and same-sex marriages have been recognized in the state since May 17, 2004. Thus discrimination against married same-sex couples applying for a mortgage in Massachusetts has been illegal for over 5 years.

A call to the Legal InfoLine at Gay & Lesbian Advocates & Defenders confirmed that if a company wants to do business in Massachusetts, statements like “You are married but the system doesn’t yet know how to handle same sex marriages” won’t fly. We were, indeed, being illegally discriminated against.

Despite their discriminatory treatment of us on the application, WFHM did approve us for a mortgage. Until that happened, however, we were highly stressed because we didn’t know how far the discrimination might go. And while we could have switched to a different mortgage provider after we recognized the discrimination, doing so meant we would risk losing our bid on our new home by no longer meeting the very quickly approaching loan qualification deadline stipulated in our purchase and sales agreement.

Besides confirming what we suspected, the call to GLAD was instructive in another way. The people at GLAD that I spoke with were surprised to hear a complaint about Wells Fargo, a company with a stated commitment to diversity and a long track record apparently backing it up. GLAD hadn’t heard of other complaints of Wells Fargo discriminating against customers. The facts taken together seemed to point to localized ignorance and/or poor training in a regional office of Wells Fargo Home Mortgage rather than a company-wide policy of discrimination.

The question remaining was, what should we do about this? Nobody could reverse the humiliation we had felt or relieve us of the stress of uncertainty we had already endured. The most important thing, we decided, was to secure assurances from WFHM that the problem in their system would be identified and errant employees would be properly trained so that nobody else would have to face this discrimination. And, we would ask for an apology.

When I called the main number for Wells Fargo Home Mortgage and explained that I had a discrimination complaint, I was immediately connected to Mr. John Petermeier in the Office of the President. I expressed our desire that the flaw in the WFHM system be corrected so that nobody else would have to face this discrimination. I stressed that we weren’t attempting to get anyone in trouble, that we just wanted assurances that WFHM employees would be properly trained and treat all customers equally.

Mr. Petermeier said he would investigate the situation and consult with WFHM’s legal and compliance departments, then sent us the following letter (link added).

Wells Fargo Home Mortgage, a division of Wells Fargo Bank, N.A., (“WFHM”)

August 19, 2011

This letter is in response to our conversation on August 12, 2011, regarding your loan application.

WFHM wants to apologize that you did not receive the service you expected. Your correspondence was forwarded to management to review and take appropriate action as needed.

Please be advised that WFHM does not tolerate discrimination and complies with the Equal Credit Opportunity Act (“Regulation B”).

As discussed in our conversation, WFHM has corrected your Uniform Residential Loan Application to show you are a married couple filing a joint loan application. I have enclosed the corrected application for your records.

If you have any additional questions, please contact me directly at [redacted] or toll free at [redacted]. I am available to assist you Monday through Friday, 8:00 a.m. to 5:00 p.m., Central Time.

Sincerely,

John Petermeier

Executive Mortgage Specialist, Office of the President

Mr. Petermeier had been more forthcoming over the phone, so I found this letter disappointing. We appreciated their retroactively correcting the loan application, but we didn’t feel that the statement “forwarded to management” was a very solid a commitment to address the specific problems we faced here in Massachusetts.

So we’re left with having to trust that Wells Fargo Home Mortgage will follow through and train their employees to treat all married couples in Massachusetts equally. Doing so would be in line with the company’s stated values. It would also be in the interest of their reputation and bottom line since discriminating against same-sex couples in a state with such clear anti-discrimination laws only invites lawsuits.

Cross-posted at Pam’s House Blend

It’s easy to be ready for others to fight the good fight. For others to stand up for themselves (and everyone else) when they are discriminated against. We forget that, when it happens, those who are discriminated against are often vulnerable, often for wholly unrelated reasons.

In spite of your already difficult situation and (I’d bet) being very short on time, you took extra time to make things better for others. To help ensure that the next person doesn’t face that bit of discrimination.

Thank you.

For clarification, were you and your wife originally denied the loan, or were you denied the right to be labeled co-borrowers instead of separate borrowers?

If so, did this affect the cost of the loan or your ability to hold title in the manner you desired?

We were not denied a loan and as far as we know the cost of the loan wasn’t affected. We weren’t prevented from getting the type of title we wanted. If any of those things had happened, we would have proceeded differently. What we were denied was the ability to apply as co-borrowers. Not only was having to apply separately an insult, discriminatory and introduce fear/uncertainty for us into the equation, it was more work for us.

The funny thing was that when we moved to Washington about 5 years ago, we were not married or domestic partnered (neither would have been recognized in WA at the time anyhow), yet we had no problem whatsoever applying for and securing a loan as a couple.

This is just the type of stuff that made the Stonewall rioters so just.

“Damn”, they thought. “I bet if we ever get the right to marry and every other right the guys in IT are going to take their sweet time in making sure the forms reflect it. How will we ever enjoy are new rights? No siree.

Sounds like someone wants so hard to be the next Rosa Parks.

Lighten up Laurel.

Laurel is entirely up front about the fact that she was able to get a loan and that this incident apparently didn’t cost her any money. But you know what? The banks have had seven years to get this right. The forms should reflect the reality of the law in MA, and they shouldn’t require people who can legally apply as a married couple to apply as though they were legal strangers to each other. Can you point to another aspect of MA law with which the banks have taken seven years to comply? Putting aside their illegal foreclosures, of course.

it’s the attitude. According to GLAD Wells Fargo has always been a friend to the gay and lesbian community. What evidence is there that is no more than a breakdown in the data collection/mortgage application/IT/sensitivity/diversity people at the bank.

Laurel’s needless attack is another slice of you-can’t-win-with-these-people or they’ll-always-consider-you-the-enemy attitude that many people wrongly believe predominates civil rights causes as they mature. This makes it difficult for some sympathizers to want to get involved.

You know what I mean, the zealots ruining it for everyone else.

So I repeat.

Lighten up Laurel.

That’s all I’m saying. So I’ll say

Whatever the reason, I feel sad for you.

I don’t know about anybody else, but I for one find such “commentary” boorish and rude. Out of courtesy to you, I’ll try to continue assuming that your hostility comes from something other than homophobia, misogyny, or both.

Do you also run around restaurants insulting diners whose conversation you don’t like? Nobody forces you to participate in threads you find boring or inconsequential.

Let’s try this agin,

laurel, although I appreciate your discovering of this institutional nomenclature that results in their software not allowing the input of two people of the same sex being married to each other.

I agree that this is something that could make a gay person feel inferior and thus should be corrected.

However, I do not agree that this is an issue about employee training, discrimination, or one worthy creating the appearance of high outrage.

The finishing touches can take awhile without malicious intent. At best negligence is the cause of this over sight. It appears from GLADD that Wells Fargo has always done the right thing.

From reading this post I sense hostility and with a touch of “I gotchya like power trip” which caused me to look deeper at the facts.

Generally attitudes like Laurel’s helps keep us divided. Here’s Wells Fargo doing everything it is asked since day one and rather then pointing out to your friend that he accidentally under paid on the bill you call the point at him and scream thief.

BTW I fail to follow your argument comparing conversation between regular users on a blog of political discourse with the catch phrase “reality based commentary” with a person in a restaurant butting into the conversation occurring at another table with his opinions?

Perhaps you could help me and clarify the analogy so I may respond accordingly.

Is this boorish and rude somervilletom?

Perhaps you could have protested by

The “system” presumably has a line labelled “Borrower #1” and another line labelled “Borrower #2”. What does a computer care if both names are of the same gender? For that matter, why can’t there simply be joint borrowers, whether married or not, especially if both names are on the bank account?

Laurel is right that the emailed response doesn’t fly.

But, at the same time, I’m having trouble figuring out what the issue was. What is the difference between a co-borrower and a separate borrower? The terms seem to be synonyms. Was the approval process more favorable to one than the other?

I think “the system” that needs to be updated is a bit larger than Wells Fargo.

My understanding is that a loan application is called the Uniform Residential Loan Application because it’s the same for everyone nationally. Documentation requirements are also standardized and fall out of the things you fill out on the application — income, for instance, will be documented with your federal tax information.

Your federal tax status should be “single” (cue Defense of Marriage Act constitutionality discussion here). So the tax returns you use to document your income will show you as single. So the Uniform Residential Loan Application should filled out with you listed as single.

Discriminatory? Yes. Nonsensical? Sure. Another example of conflict between federal and state marriage law? Check.

I may not have a complete understanding of the details. But I think Wells is just sliding down the greased rails of federal policy, and any call to action or ire should be directed more broadly than at Wells alone.

So…I thought this one deserved a little follow up, if only to serve as a marker of change.

This September, the Veteran’s Administration reversed its policy for VA loans, which it guarantees. In their words, they’ll “…begin reviewing applications for the home loan guaranty benefit for same-sex married couples in a manner consistent with processes currently used for opposite-sex married couples.”

Score one for the good guys. I’m unsure whether the big picture has changed for all loans; seems like it’s on the way, if not.

For those who like details, the full VA decision is available via a google search on VA Circular 26‐13‐18.