It seems like with each new rebrand of the Baker campaign they start with a new commercial and slogan then come out with new attacks. Past attacks have gone nowhere as the details of the half truths become public knowledge. One might also argue that Baker should instead focus on providing voters honest answers to difficult issues. But alas the Baker campaign decided to go a different route. This time the Baker campaign is going hard after the property tax issue. Today in Milton Baker goes on the attack:

He said the property tax was the tax to cut, and Treasurer Tim Cahill endorsed the governor and together they campaigned and governed for the past four years. It is another broken promise of Deval Patrick and Tim Cahill.”

Baker said property taxes have gone up in the last four years by 11 percent.

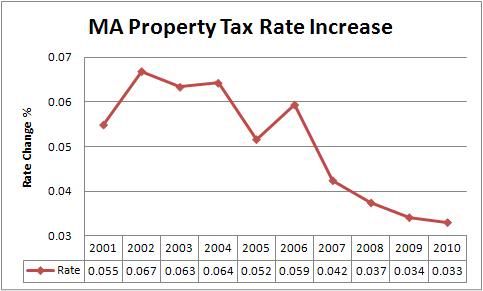

The Baker campaign then puts up a web ad on property taxes which is gleefully posted on BMG. Interesting, right? But when you look at the Property Tax Information in the DOR website you see a different picture. The fact of the matter is Deval Patrick lowered the rate increase on property tax in each year he has been on office. Mitt Romney’s last year property tax increased by 5.9%, Patrick lowered the rate to 4.2% in his first term and in 2010 the rate is now down to 3.3%.

The Patrick campaign put out a fact sheet on property taxes and pointed out that even under the largest recession since the great depression the administration for the first time in 20 years has been able lower the rate change three years in a row.

For the first time in twenty years and amid a global economic recession, property tax increases under the Patrick-Murray administration went down three years in a row – from 4.2% in the first year of the term to 3.3% presently, representing a 22% decrease.

Charlie Baker on the other hand didn’t fair as well. Baker as you know was the Secretary of Administration and Finance under Weld and Cellucci, as the head finance guy Baker’s property tax averaged an increase of 4.38%, that’s higher than any under Patrick. To add insult to injury Baker is attacking Patrick when he is fighting to keep property taxes lower in a global recession with less revenue, Baker on the other hand increased property tax at a higher clip when he was presiding over a $1 billion budget surplus. I don’t see how Baker could attack Patrick when it was clear that property tax relief was not a priority when he was managing the budget.

The obvious way to fudge the figures here is to up property values on a quarterly basis. That way cities and towns get to hire contract appraisal firms who don’t offer medical insurance benefits.

<

p>Tax rate becomes much less relevant than property valuation. Plus when you go to sell and cash in on your “investment” you may find the property not “up to code”.

property rates on a quarterly basis. Property is typically reassessed every 3 years.

My Town reassesses the property every year, as all towns should. It’s a computer model — there’s no reason to update it anything less frequently than the frequency of the muni budget.

Boston does assessments every year. Market sales of similar properties that sold in the previous year are analyzed, compared and adjusted to forecast what the specific property would sell for on January. Most residential property in Boston is valued by the “market approach” in this way. The abatement process allows appeal of these valuations.

three years to assess them? I’m a selectman, not an assessor.

In my Town, they rarely actually visit — they know what you own in 2009, they see that you didn’t get a building permit in the last year, they know what you’ve got now. Data on sales over the past year gets added to the model, and they predict what your home would sell for this year.

<

p>It isn’t perfect — in my community I think that they’re over valuing condos and under valuing detached homes, but that’s the system. Each year your home is worth a “new” amount, they adjust the tax rate to comply with 2.5, and you get sent a bill each quarter.

They visit homes periodically. I confused that with reassessing them.

The governor doesn’t raise nor lower local property taxes. There were overrides during Romney’s time because, no fault of his, the economy was hot. Communities wanted more government, and they were willing to pay for it.

<

p>Nowadays, while governments wish they had the additional revenue, there’s no appetite for higher taxes during a tough economy, and the overrides just aren’t there. The bad economy is no more Governor Patrick’s fault than the hot economy Governor Romney’s.

<

p>

<

p>The hole in my argument: 2007. 2007 had low unemployment — the bubble hadn’t burst yet.

on some important issues with costs on towns and cities. The largest is health care. It’s not 100% but he has made in roads on possibilities for towns to help reduce costs. Where was Baker? What plans did the 20 years of Republican governors? The fact of the matter is Patrick has done more to reduce costs for towns than Weld/Cellucci/Swift/Romney combined. Baker was there heading the budget for the first two. If Baker had started what Patrick has done 20 years ago we would be a lot better off as a state.

and may very well be part of the reason. I wonder though: what makes 2007 such an outlier?

…thinking fact have anything to do with an election. Using facts to counter perception is a good way to lose an election.

“The fact of the matter is Deval Patrick lowered the rate increase on property tax in each year he has been on office.”

<

p>Forgive my ignorance, but am trying to figure out how any governor R or D has any direct impact on property tax rates? Can someone explain this? I’m not defending either side here, but am confused as to why this is being touted as a governor’s issue when this is really an issue dealt with locally? I suppose on one hand if the local aid continues to be cut it forces communities to seek overrides — is this what this is all about? I’m just looking for the facts and a clear explanation…

please copy me on your letter.

that Patrick has started on a few items that benefits cities and towns to reduce costs. It’s a difficult nut to crack, but he’s started. He’s also introduced options on different revenue streams other than property tax. Zero solutions provided from Baker.

It’s really more about making communities less reliant on overrides… fair enough, but I’m not sure that is quite the same as lowering property taxes… perhaps I’m splitting hairs.

<

p>If they really wanted to get to work on some fairness to communities, they’d take a hardcore look at Chapter 70 funding, SPED reimbursement and mandates, Lottery distribution calculations and charter school funding schemes. Gloucester gets screwed on every one of those counts and Gov. Patrick said he’d work to fix them, but I’ve not seen a whole lot of movement….

<

p>I’ll give him credit on the healthcare initiatives and opening up the state system to local governments, but I’d wished he’d pushed harder to allow municipalities to join without being hamstrung by bargaining units — it’s too high a hurdle when communities have no bargaining power to begin with. But it was a step forward.

that is

State doesn’t set property taxes directly, but can affect towns’ actions by amount of local aide. Personally, I’d love to see one or more of the following:

<

p>Repeal of Prop. 2 1/2

Fund municipal services other ways

Institute statewide property tax like NH

Guys, you have to be kidding right? The Governor promised in 2006 to cut property taxes. Your graph and his statement is a clear misdirection response.

<

p>He did not cut property taxes nor could he have.

<

p>Slowing the increase is not a cut.

<

p>The reality:

<

p>Ok, so I didn’t cut them, but actually just slowed the increase. It’s kinda like a guy who’s starving because we gave him less food and tomorrow we’ll give him even less food but not the same reduction we gave him the day before, but less food.

<

p>Ok, bad example.

<

p>Try this. You’re up to your nose in water and the best way to stop from drowning is to take away water. Well, I didn’t stop the water but I added less. Ok, ‘nother bad example.

<

p>Look, the governor can’t really do anything about property taxes except that when Baker was in government he caused them to increase faster than I did, but I really didn’t because I can’t do anything about property taxes; that’s local government’s decision.

<

p>Look at my graph; it’s going down. See!

then his record is game. What did Baker do for property tax relief when he was sitting on a billion surplus. What policies were initiated? Ziltch. Therefore, the attack.

<

p>Here’s what Baker should have said in in latest ad:

<

p>”Charlie Baker: I have no solutions!”

is talking about reality. The reality of the situation is that we are in a global economic recession. Don’t you think it’s good to have Baker talk about his record and what he’s done as budget chief to help in property tax burden? I think it’s now open for discussion, if he wants to attack Patrick. I don’t think you let the attack go without a response.

Interesting commentary, johnk.

<

p>People who pay a mortgage may remain blissfully ignorant of the amount of their tax bill, as it’s rolled into their mortgage payment. Whereas those who are no longer paying a mortgage see the bill and are aware of year to year increases.

<

p>To that extent, when those average increases are sizeable, as they were in the early part of this decade, it can be quite a smack in the face. But as some have already noted, a large part of what drives the amount of the tax bill is the assessed value.

<

p>Assessed values were going up in the Romney years (an increase of 63%) and going down in the Patrick years (a decrease of just 3%). We also see that when Romney took office, the average tax bill was 12.7% of the property value. When he left office, it was down to 9.8%.

<

p>Bottom line is, my home is worth less but I’m paying more of a share in taxes. It’s a loss for the property owner on both these measures.

<

p>There’s not enough data to conclude Romney did something right or Patrick did something wrong. I think it is mostly a reflection of the housing market. So, touting this data could backfire on Patrick if his opponents were able to show the value comparison in way that was as easy to understand as a rate increase.

<

p>Source:

DOR FY1990 – FY2010 State Total Average Single Family Tax Bill

Assessed values were going up in the Romney years (an increase of 63%) and going down in the Patrick years (a decrease of just 3%). We also see that when Romney took office, the average tax bill was 12.7% of the property value. When he left office, it was down to 9.8%.

<

p>ADD: Now, the average tax bill is back up to 11.7% of property value.

“We also see that when Romney took office, the average tax bill was 12.7% of the property value. When he left office, it was down to 9.8%.”

<

p>Surges in the market do not proportionately lift or lower your tax bill, but rather affect your tax RATE — since the amount raised by a community is set by 2.5 and doesn’t go down, your tax rates will end up rising or lowering per thousand to compensate… The amount you pay as a percentage of the value of your house is going to change with the property valuation which is why the Romney numbers look sexy — but it’s an illusion.

Remember that the levy amount can rise by 2.5% plus new growth. This resulted in many communities with ample room to raise tax bills even with decreases in tax rates. If your assessment went up 10% in a year, your community likely had enough of a growth buffer to apply that 10% increase to your tax bill.

<

p>How is this done? My guess is the new homes that contributed to the rise in growth rate are under-assessed in their first year. So long as growth continues, the growth can be passed to existing home assessments. I don’t think this is done maliciously. Initial assessments are done based on the existing values of neighboring homes, and it isn’t until the new homes are sold that the value of area homes goes up.

<

p>Because there are new homes with which to share the tax burden, the tax rate may go down by 1-2%. But because the increase in market value — the growth rate — is outpacing that, your individual bills will increase more than that.

<

p>Also note that I did not argue that market values proportionately lift or lower a tax bill. If I had, I would have said that the average tax bill during Patrick’s term should have decreased some amount to reflect the deflating property values.

<

p>What I do state is that there is a value ratio — the amount of tax I pay relative to the value of my home, that is a better measure than the absolute value of the tax bill. This is acknowledgment that the promise of “lowering tax bills” is pretty ridiculous on its face because communities can almost always levy more from year to year, even with no growth.

<

p>I understand your point that the more property values go up, the better the ratio, but I think there’s more there. You can look at the time period from 1998-2002 when property values increased by 43% but the ratio decreased (1.7%). Compare this to the time period from 2002-2005 where property values rose by about the same amount. The decrease in the ratio was (2.7%).

<

p>So, something is going on there that delivered better value. But there is not enough data in this table to say what that was let alone who or what it can be attributed. But I think it’s a little more than just a sexy ratio.

<

p>

It is possible to get endlessly tied up in rates, assessed values, etc. But I find it better to view it a little more simply than that.

<

p>Valuations are merely a way to apportion the tax levy. People pay a tax amount based on their share of the total valuation in the city or town. If you own 10% of the property (by value) in the town, you will pay 10% of the tax levy. That means the levy amount is the key to judge how towns “raise taxes”.

<

p>Without new growth, it is a simple concept — a city or town can increase their levy by up to 0.25% over the prior year’s levy. They may choose to increase by less than this amount, and can “store” that increase away for when they need it, but the number is deterministic, and has nothing to do with valuations (except when you’re up against the $25/1000 levy ceiling).

<

p>New growth is trickier to understand. It is excluded from the 2.5% increase in levy when it is “new”, but is included the following year.

<

p>I think that the town’s interests lie in overvaluing a house in its first year. Picture this: a town has 10 properties, each equally valued at $1m each, total value of $10 million. Tax rate is $10. Existing houses bring in $100,000 in levy.

<

p>A new house is built and is assessed at $10 million. The $100,000 in taxes from that new house are not subject to the Prop. 2.5 limits for the first year. That means the levy can go from $100,000 to $200,000 (assume the community does not take an addition 2.5%).

<

p>Second year the house resells for $1m, not $10m. But the town has $200,000 in levy which it now distributes across 11 houses. Everyone’s taxes are higher.

<

p>I think that this is a way that suburban communities do so well — new growth gives more of a fudge factor. With no growth the number is incontrovertible — 2.5% increase in levy. New growth allows for games to be played, either deliberately or accidentally (homes being valued more in a boom). Built-out communities do not have this relief valve.

<

p>That theory lines up with the governor’s graph. New construction has slowed, so the levy increases are going to be closer to 2.5%. Less fudge factor avaialble.

<

p>As a corollary, using taxes on the “average house” seems to be a worthless indicator because ew growth can push up the average house price without existing houses actually increasing in value. In my example, the “average house” went from $1m to $1.8m simply because a new expensive house was built.

<

p>This is a tough issue to argue on, because the general public simply does not understand property taxes at all. They don’t get the concept that the rate is largely meaningless. They think that a town can raise valuations to get more tax money. They never look long-term at their taxes – so their taxes can decrease by 5% for 5 straight years, but when they go up by 10% the 6th year, they scream bloody murder and invoke Proposition 2.5.

<

p>I think the right way for the governor to approach this would be to show how his alternate revenues plus more restrained cutting of local aid has filled in the revenue streams of communities. Compare his local aid cuts with those done by Weld and/or Romney, and show how communities had more choices on the table under him — they could cut spending, or they could fill in the revenue with meals taxes, etc. to preserve services.

Without the benefit of an accounting degree, or the time to look over the data you’re looking at, I can’t argue one way or the other…. I do however think that there is a lot of misunderstanding about Prop 2.5, how it applies to individuals vs the community as a whole and the notion that Governor is in any substantive position to, as a matter of policy, raise or lower property taxes independent of the other factors involved.

<

p>If local aid is slashed and a community responds by raising taxes that’s one scenario. It’s unlikely, but possible, that if local aid were equitably distributed and actually supported the mandates that the state imposes on localities that there might be a downward impact of property taxes… BUT and here’s the big but… cuts in local aid, skyrocketing healthcare costs, un or underfunded mandates have all contributed to communities having to cut services, defer investment and otherwise pinch whatever penny they do have…

<

p>While an override has proven difficult to sell in our community, the simple truth is that with all the above issues to contend with, lowering our property taxes would simply increase the pain of providing local services. We’ve got tens of millions, some reckon 100s of millions of dollars in capital project costs to address serious needs in our city: sewer and water infrastructure, failing roads, schools and municipal buildings in tragic conditions — all put off because higher priority issues take center stage for the few dollars we do have and as a consequence the magnitude of the problem compounds itself.

<

p>I’d rather see a state wide property tax and the elimination of Prop 2.5 which has caused so much harm to our state. Take a look at other states like New Jersey and New Hampshire… our property taxes pale in comparison, yet folks scream about Taxachusetts….

At least in Boston, we get quarterly tax bills from the City even though it is payed through our mortgage escrow. So I do know how much my tax bill is. No doubt I would be more aware if I had to actually write out the check myself.

<

p>Also, aren’t your percentages off by a factor of magnitude? Tax rates are often stated as dollars per thousand dollars of property value, so perhaps you are confusing that with percentages.

There have been some great success stories over the last 4 years. But if you contort the facts on this issue, it detracts from those.

<

p>When debating tax cuts, Deval DID repeatedly promise to work to cut property taxes, and they have gone up 11%.

<

p>Now you can debate that an economic downturn was unexpected or that a Republican administration would have been worse, but not that the Patrick administration has been successful in keeping this particular campaign promise.

<

p>If communities had continued to raise their taxes despite increases of State aid, then that would be out of the control of the State. But that’s not what happened.

<

p>Many of us are disappointed that we did not realize the more progressive tax structure that was promised and do not see a reduction in the increase as an equivalent to a decrease. We are grateful for the real successes of lobbying and ethics reform, fiscal responsibility and environmental progress, but if you claim this as Mission Accomplished, all your future campaign promises become suspect.

that I wouldn’t make this the central part of the campaign. But it’s not, it’s unfortunately addressing attacks by a candidate that does not offer solutions. Attacks like these cannot go unaddressed, especially with the record that Baker has on this issue.

Torturing the statistics so he can show a graph pointing downward approaches deception.

<

p>K-I-S-S. Here’s the total residential taxes collected. The source is that same DOR website, an 11% increase over the term.

<

p>2007 7,747,337,003

2008 8,056,895,653

2009 8,308,041,908

2010 8,595,199,392

<

p>There’s a school of opinion that says the Governor can’t do anything, but that’s Bull****.

<

p>If he or the legislature actually was motivated to reduce property taxes, it would simply propose a Bill that allowed taxpayers a tax deduction on their Massachusetts income tax form for property tax paid, or else a credit. I’ve not seen that proposal from the Governor’s office.

he increased property tax 21.4% when he was budget chief, and he was sitting on 1,000,000,000 surplus, and on top of that proposed no policies for relief. Seems like the guy to vote for.

It could be done, and it would be done like this:

<

p>1. MA allows property tax to be income tax deductible — which helps people with big incomes and big properties an awful lot, but it doesn’t help those on small fixed income very much (seniors), and it skews the rental market in funny ways.

<

p>2. MA, which needs the money to maintain it’s own budget, reduces expenses to match the reduced revenue. Which expense? Local aid.

<

p>

<

p>End result: town budgets are reduced, seniors are worse off, and folks with big incomes and big homes are better off. Is that better?

BTW – I’ve been arguing on another thread that the state has ZERO real effect on property tax, and that it is a local responsibility, and have been told I am wrong. It’s nice to see people agree with me.

<

p>I can give you two scenarios how I believe the state could affect the property tax. Can you tell me why you think I’m wrong?

<

p>First scenario, the state says “everyone’s local aid is now doubled”. Forget about the merits or likelihood of doing this. What do you think the effect would be? I think that every single community would devote at least some of that money to lowering property taxes. Some would put it all into lowering property taxes, others would prioritize it to improve services first, but with so much extra cash it would be hard to find enough to spend it on.

<

p>Second scenario, the state passes a law that allows communities to raise revenue in a wide variety of ways. Maybe a tax on residents’ income, maybe a tax on workers’ income, maybe devoting a portion of the sales tax to the community, maybe earmarking a portion of lottery ticket sales to the community in which the ticket is sold, maybe allowing for electronic tolling. The state could even put some stipulations on the money, like “if you raise the income tax by 1 cent, you need to lower your tax levy by 1/2 the amount raised” or some other fancy formula.

<

p>How do you expect me to believe that if those communities were given money from elsewhere, that they would not change their property tax strategy one iota? How is that even a plausible argument?

One could argue that the Governor created a situation that indirectly led to less upward pressure on property taxes. I don’t know if the argument would be valid, but there is no direct way for him to lower property taxes.

<

p>Politically, I say let the slogan rip. It’s at least as true as saying Romney didn’t raise taxes. H raised fees considerably. My lifetime FID card now costs $100 every 4 years. I think I paid, um, nothing before that.